Fintech hub

The Ultimate Guide to Financial Technology

In recent years, financial technology, or fintech, has transformed the financial industry, reshaping how financial services are delivered and consumed. From innovative fintech companies revolutionizing banking services to cutting-edge fintech apps simplifying financial processes, the fintech industry has seen explosive growth and continues to evolve at a rapid pace. This guide delves into the world of financial tech, exploring the various types of fintech, key trends, notable fintech companies, and the impact of fintech innovations on traditional financial institutions.

As technology continues to integrate with finance, the landscape of financial services is changing dramatically. Major banks and neobanks alike are adopting fintech solutions to enhance their offerings, improve customer experiences, and stay competitive. Blockchain technology, mobile banking, and digital wallets are just a few examples of how fintech is driving innovation in the finance industry. This comprehensive guide aims to provide a deep understanding of financial technology, its applications, and its implications for the future of finance. Whether you're an investor looking to understand the latest fintech trends, a financial advisor exploring new financial products, or someone interested in fintech careers, this resource will equip you with the knowledge needed to navigate the dynamic world of fintech.

Exploring the Different Types of Fintech

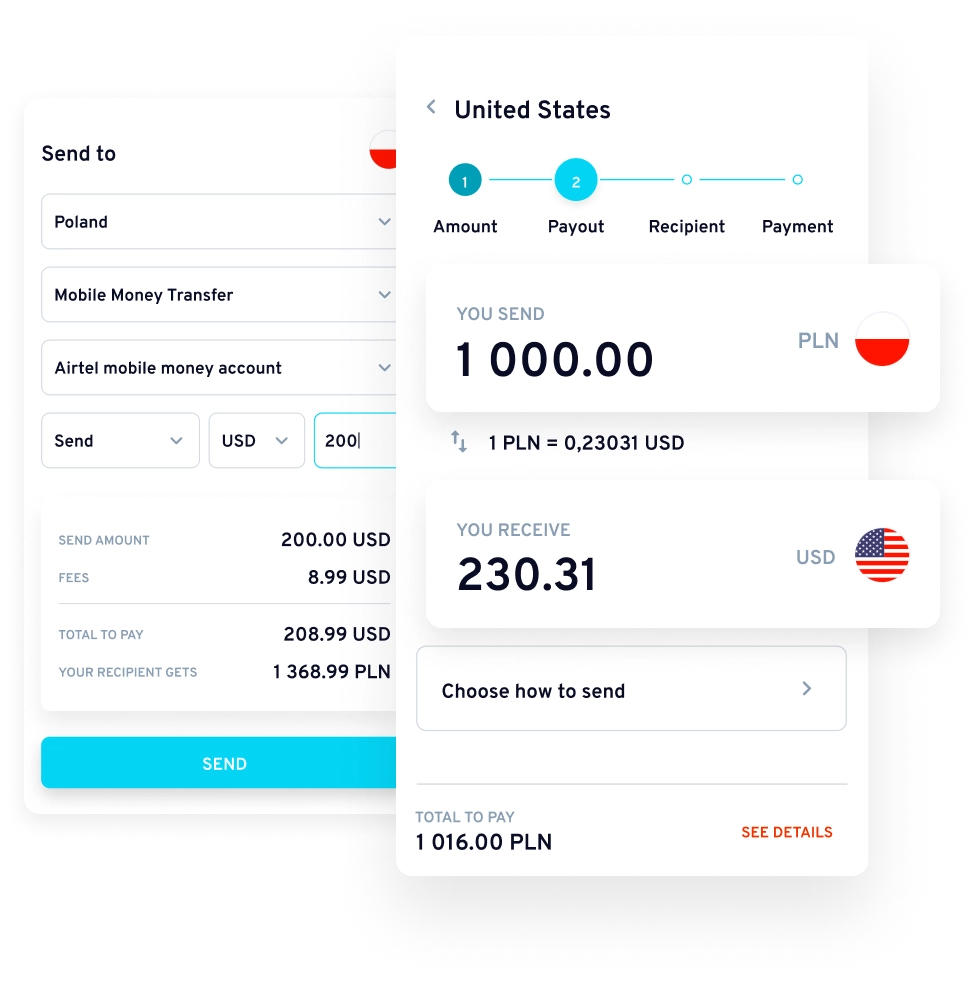

Financial technology, or fintech, encompasses various applications that are transforming the financial industry. One major category is payment solutions, including digital wallets and peer payment services, which facilitate seamless financial transactions. Companies like PayPal and Apple Pay have revolutionized how we handle money, making cashless transactions more convenient. Personal finance and budgeting apps, such as Mint and YNAB, help individuals manage their finances, track expenses, and achieve financial goals. Additionally, investment platforms like robo-advisors (e.g., Betterment and Wealthfront) provide automated, low-cost investment management tailored to individual financial needs.

Another significant area in fintech is insurtech, which uses technology to streamline insurance processes. Companies like Lemonade offer personalized insurance products and faster claims processing through AI and data analytics. Regtech (regulatory technology) helps financial institutions comply with regulations efficiently by using advanced software to monitor transactions and manage compliance risks. Open banking is also a transformative trend, promoting financial transparency and innovation by allowing banks to share customer data securely with third-party providers. This integration fosters competition and encourages the creation of new financial products and services, driving significant changes across the finance industry and enhancing financial inclusion.

Comprehensive List of Fintech Articles

19.05.2025

Marcin Sadowski-CTO @ JS and Web3 Expert

Matt Sadowski -CEO @ fintech expert and advisor

Explore the Future of Fintech App Development in 2025

Looking to stay ahead in 2025 with Fintech App Development? Discover strategies, trends, and real-world use cases here. Unlock the potential today!

Read full article

25.03.2025

Matt Sadowski -CEO @ fintech expert and advisor

The Future of Financial Services: AI for Fintech

Discover how AI is revolutionizing fintech! Learn about the impact of Artificial Intelligence on financial services. Click to explore AI for fintech now!

Read full article

10.01.2025

Matt Sadowski -CEO @ fintech expert and advisor

Top Fintech Conferences That You Cannot Miss in 2025

Top fintech conferences in 2025 around the world. Unique selection by the Mobile Reality team!

Read full article

23.04.2024

Ewa Sadowska-HR & Administration Manager

Fintech Week NYC: Key Trends and Transformations

Explore key insights from NYC Fintech Week, featuring panels on WealthTech, regulatory issues, and the future of finance with Mobile Reality's CEO.

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Marcin Sadowski-CTO @ JS and Web3 Expert

Leveraging Blockchain for Fintech: A Look Ahead to 2025

Discover the future of blockchain in fintech with insights on industry trends and opportunities for 2025. Stay ahead in blockchain finance!

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Top Fintech Companies in New York in 2024

Discover top fintech companies in New York City making waves in the industry. Stay ahead of the game with these innovative leaders. Find out more now!

Read full article

In world of financial tech, the impact of fintech companies cannot be overstated. From innovative fintech startups to fast-growing companies, firms highlighted by our research team in our publications are at the forefront of transforming financial services and institutions through groundbreaking technologies. Integrating financial technology into banking, investments, and payment solutions is revolutionizing how we interact with money, enhancing financial inclusion, and setting new standards for the finance industry. As we continue to witness rapid advancements and trends in fintech, it is clear that these industry leaders are shaping the future of finance for the better.

Fintech Industry Leaders

01.10.2025

Matt Sadowski -CEO @ fintech expert and advisor

Top 10 Fast-Growing Fintech Companies in the US in 2025

Read full article

29.07.2025

Matt Sadowski -CEO @ fintech expert and advisor

Top 10 Fast-Growing Fintech Companies in the EU in 2025

Read full article

13.06.2025

Matt Sadowski -CEO @ fintech expert and advisor

Top 10 Fast-Growing Fintech Companies in the UK in 2025

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Top Investment Apps in Europe in 2024

Read full article

13.06.2025

Matt Sadowski -CEO @ fintech expert and advisor

Top 10 Fast-Growing Fintech Companies in the US in 2024

Read full article

29.07.2024

Matt Sadowski -CEO @ fintech expert and advisor

Top 10 Fast-Growing Fintech Companies in the EU in 2024

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Top 10 Fast-Growing Fintech Companies in the UK in 2024

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Top InsurTech Companies in the UK in 2024

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Top 10 Best Investment Apps for Business in the US

Read full article

14.01.2025

Matt Sadowski -CEO @ fintech expert and advisor

Top Fintech Software Development Companies

Read full article

10.01.2025

Matt Sadowski-CEO @ Custom Software Development Expert

Top 5 Wealth Management Solutions in 2025

Read full article

30.07.2024

Matt Sadowski -CEO @ fintech expert and advisor

Stanislav Naborshchikov-Solutions Specialist

TOP 10 KYC & AML software companies in 2023

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Stanislav Naborshchikov-Solutions Specialist

Top 10 fast-growing fintech companies in the EU in 2023

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

Stanislav Naborshchikov-Solutions Specialist

10 fast-growing top fintech companies in the US in 2023

Read full article

20.12.2024

Matt Sadowski -CEO @ fintech expert and advisor

10 fast-growing top fintech companies in the UK in 2023

Read full article

Frequently Asked Questions (FAQs) About Financial Tech

Examples of top fintech companies include PayPal, Coinbase, LendingClub, Betterment, Wealthfront, and Lemonade. These companies are known for their innovative financial products and services that have significantly impacted the finance industry. Additionally, you can explore our articles highlighting various fintech companies:

Fintech lenders use technology to streamline the lending process, often providing faster approvals and more personalized loan products. They typically offer lower interest rates and fees due to reduced operational costs, making borrowing more accessible and affordable for consumers.

Fintech works to improve financial services by leveraging technology to streamline processes, enhance user experiences, and reduce costs. It encompasses a variety of applications, such as mobile banking, digital wallets, and blockchain technology, which make transactions faster, more secure, and more convenient. Fintech also uses AI and machine learning to provide personalized financial advice and detect fraud more effectively.

Open banking is a system that allows banks to share customer financial data securely with third-party providers through APIs. It promotes innovation, competition, and the development of new financial products and services, ultimately enhancing customer choice and financial inclusion.

The main types of fintech include payment solutions (e.g., digital wallets and peer payment services), personal finance and budgeting apps, investment platforms (e.g., robo-advisors), insurtech, regtech, and open banking. Each of these categories leverages technology to enhance financial services and user experiences.

Current fintech trends include the rise of blockchain technology and cryptocurrencies like Bitcoin, the adoption of AI and machine learning in financial services, the growth of mobile banking, the expansion of open banking, and the development of decentralized finance (DeFi) platforms.

Blockchain technology enhances fintech by providing a secure, transparent, and decentralized way to conduct financial transactions. It underpins cryptocurrencies, enables smart contracts, and offers potential applications in areas such as supply chain finance and digital identity verification.

Financial tech, or fintech, integrates technology into financial services to improve and automate banking, investing, and other financial processes. It encompasses various applications, from mobile banking and digital wallets to blockchain technology and robo-advisors.

Fintech companies drive innovation in the financial industry by offering more efficient, user-friendly, and cost-effective solutions than traditional financial institutions. They challenge major banks and financial firms to adopt new technologies, improve customer service, and increase operational efficiency.

Fintech apps are software applications designed to facilitate various financial services, such as budgeting, investing, lending, and mobile banking. They benefit users by offering convenience, real-time financial information, personalized financial advice, and lower costs compared to traditional services.

Subscribe to our newsletter!

Subscribe to our newsletter to be up to date with publications, articles, and insights from tech, fintech, proptech, and blockchain industries.