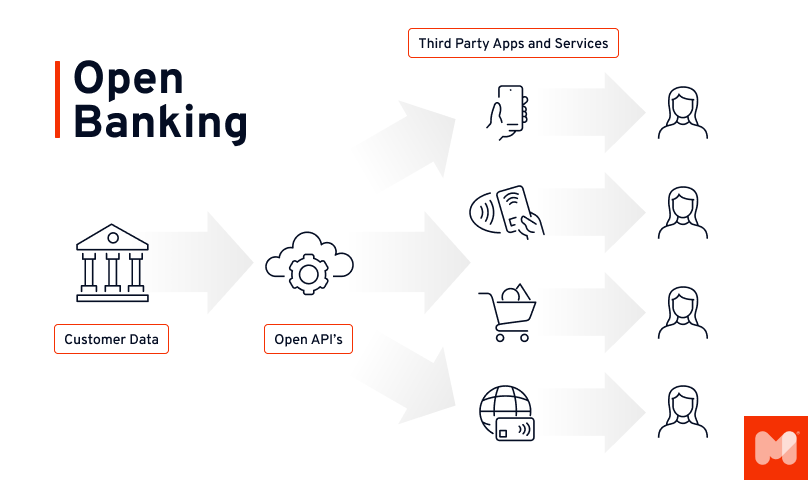

What is Open Banking API?

Open Banking API refers to open APIs, data standards, and security protocols that enable third-party developers to build applications and services around financial institutions. Banks can securely share customer-approved financial data with authorized financial technology providers through APIs. It enables third parties to develop innovative applications and services for banking customers by accessing their financial data and initiating payments. The Open Banking framework fosters greater competition and collaboration between banks and fintech companies. It gives customers more options to manage their finances, enables them to switch between financial institutions easily, and encourages the development of more personalized products and services. Overall, Open Banking API creates an open and secure infrastructure for the financial services ecosystem that benefits banks, third-party providers, and consumers.

Figure 1: Open Banking API

Understanding Open APIs

Open APIs, also known as public APIs, allow third-party developers to access and integrate with an application or service. They provide a way for different software systems to communicate and share data and functionality. Companies release open APIs to enable developers to create new platform applications and services. For example, social media sites like Twitter and Facebook provide open APIs to allow developers to build mobile apps that can interface with their services. Open APIs spur innovation as developers leverage them to make helpful tools and products. They also allow organizations to expand the functionality of their core products and grow their ecosystem of integrations and partnerships. Open APIs are a crucial technology for enabling collaboration and creativity, as they provide a simple, standard way for systems and developers to share and consume data and capabilities.

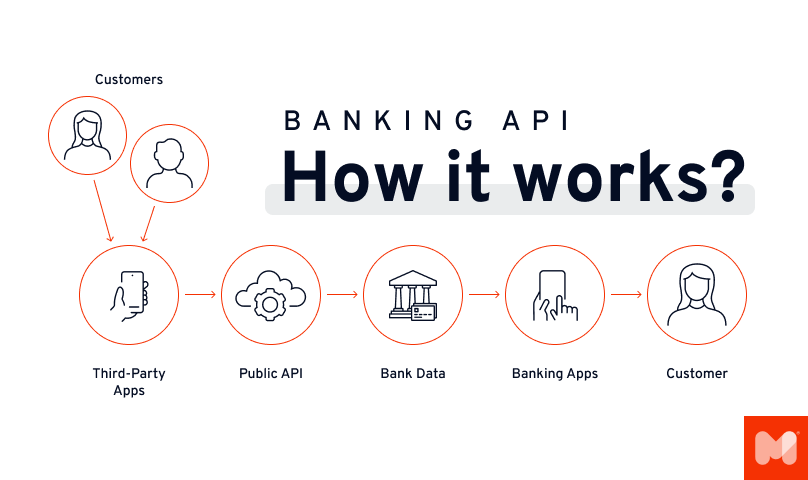

How Does Open API Banking Work?

Open API banking refers to using open APIs in the banking industry to enable third-party developers to access financial data and build applications and services around bank platforms. Banks provide open APIs that allow external developers to securely access customer account information, initiate payments, retrieve product and branch details, and perform other banking functions. Customers must explicitly allow this third-party access to their financial data.

Developers can then use these APIs to create innovative mobile and web banking apps, personal finance managers, account aggregation services, and other fintech solutions. For example, an expense tracking app could use open banking APIs to categorize transactions from a user's bank account automatically. This gives consumers more control over their Financial data and more choice in banking services. Open API banking also facilitates collaboration between traditional banks and fintech innovators. Overall, open bank project enable the banking ecosystem to become more open, secure, and competitive.

Figure 2: How Banking Open API works

Different Types of Open API Banking

Open banking APIs enable banks to securely open up customer data and services to spur fintech innovation and create a vibrant ecosystem. The different types of APIs provide varied functionality and convenience to consumers.

Account and Transaction APIs - These allow third-party providers to access customer account data like balances, transaction histories, and monthly statements with customer consent. Financial apps can use this data to provide features like automatic spending categorization.

Payment Initiation APIs - These APIs enable external apps to initiate payments on behalf of customers directly from their bank accounts. For example, a merchant app could use this to allow instant bank payments.

Identity and Security APIs - These APIs allow FinTech apps to confirm a user's identity securely and seamlessly log them into the app. This improves security and reduces friction in the sign-up process.

Product and Branch Locator APIs - Banks provide these APIs to share information about their products, such as loans, credit cards, interest rates, and branch/ATM locations and hours. This enables consumers to access financial products easily.

Customer Insight APIs - Banks use these to share anonymized customer data like demographics, transactions, and behavior. This allows third parties to understand consumer needs better and derive useful insights from the data.

Notifications/Webhook APIs - These allow banks to proactively notify Fintech apps about account events or status changes via webhooks. Apps can then take appropriate actions in real time.

Who Can Use Open Banking APIs?

Open banking APIs create opportunities for greater financial access, transparency and innovation for various stakeholders in the ecosystem. The APIs unlock the potential of banking data.

Fintech Companies - Fintech startups and established technology firms can use open banking APIs to build innovative financial applications like payment services, budgeting/financial management tools, investing apps, etc. APIs give them access to banking data and infrastructure.

Third-Party Providers (TPPs) - TPPs provide services like account aggregation, analytics, financial advisors and more. They can leverage open banking APIs to retrieve customer data from banks with consent and deliver value-added services.

Merchants - Merchants, especially e-commerce companies, can utilize open banking APIs to enable direct bank money on their platforms. It allows instant order processing and enhanced customer experience.

Developers/Innovators - Developers can use open APIs to develop new solutions, integrate bank services into products, analyze financial data to build applications, etc. It fosters innovation.

Banking Customers - Banking customers ultimately benefit from open banking as they get more control over their data, more comprehensive access to financial services, cheaper/faster payments and customized products catering to their needs.

Banks - Banks themselves use open banking APIs to reduce costs, reach new customer segments, keep up with innovation, and collaborate with fintechs by monetizing their data and infrastructure.

The Benefits of Open Banking APIs

Open banking APIs benefit consumers by providing greater access, control, and transparency over their finances. Fintechs can grow their customer base rapidly by accessing bank data to build innovative services. Finally, banks can reduce costs, generate revenue, collaborate with fintechs, and stay competitive in a changing industry. The benefits are given in the Table below:

Table 1: Advantages of Open Banking APIs

For Customers | For Fintech’s | For Banks |

More control over financial data | Access to banking systems to build apps | Meet customer demand for open banking |

Wider access to financial services | Analyze customer data to offer personalized services | Reduce costs by opening infrastructure |

Convenience of managing finances from one place | Innovate quickly using APIs | Access to more customer data for insights |

Cheaper and faster payments | Offer tailored products and services | Enable collaboration with fintech |

Customized products catering to needs | Expand customer base by reaching bank users | Generate revenue by selling access to APIs |

Enhanced financial transparency | Scale fintech platforms faster | Foster innovation culture |

Improved financial advisory services | Diversify offerings by leveraging banking APIs | Stay competitive with emerging Fintech’s |

The Disadvantages of Open Banking APIs

open banking poses risks like data privacy, security vulnerabilities, increased costs and complexity for stakeholders. Proper regulation, governance and collaboration can help manage the disadvantages.

Table 2: Disadvantages of Open Banking APIs

For Customers | For Fintech’s | For Banks |

Privacy and security concerns over sharing financial data | Limited access to bank APIs and high entry barriers | Security vulnerabilities by opening systems |

Banking errors or failures affecting third-party services | High competition in saturated fintech markets | Increased compliance and regulatory oversight |

Overreliance on fintech apps for banking needs | Scaling challenges to meet demand with banking APIs | Costs of implementing and maintaining APIs |

Fragmentation of banking and financial data | Integration complexities with core banking systems | Revenue cannibalization from fintech offerings |

Poor financial advice or mis-selling of products | Lower profit margins and monetization difficulties | New competitors entering the banking ecosystem |

Lack of regulation around data ownership | Delays in bank API approval and rollout | Customer retention challenges as switching easier |

Confusion around liability in case of disputes | Lack of standardization in bank APIs | Adaptation struggles with rapidly evolving technology |

Why are APIs in banking important?

APIs are a strategic imperative for banks to modernize infrastructure, address competition, meet customer expectations and harness the power of data. APIs are critical enablers of openness, agility and innovation in banking.

Enable Open Banking - APIs allow banks to securely open data and infrastructure to third parties and power open banking and fintech innovation.

Improve Customer Experience - APIs help provide seamless banking across channels and third-party applications. Customers benefit from more personalized, convenient services.

Increase Speed and Agility - APIs enable faster product development, quicker time-to-market and rapid integration with banking systems. It makes banks more agile.

Access New Revenue Streams - Banks can monetize APIs to generate new revenue channels from third-party developers, fintech partners, etc.

Leverage Data and Insights - APIs help leverage customer data to develop insights, analyze trends, prevent fraud, manage risks and make decisions.

Foster Collaboration - APIs allow collaboration between traditional banks and fintechs to improve services. Banks can stay competitive with emerging innovations.

Reduce Costs - APIs and microservices architecture help banks digitize processes for straight-through processing. This results in lower costs.

Ensure Security - APIs enable secure data transmission and access between systems and application programming in a controlled manner.

Improve Operational Efficiency - APIs can integrate fragmented legacy systems and automate manual processes for greater efficiency.

Matt Sadowski

CEO of Mobile Reality

Fintech Software Development Tailored to Your Needs

We specialize in delivering reliable and compliant software solutions for the financial industry, designed to meet your specific requirements.

Comprehensive development for fintech systems and financial services.

Secure and scalable solutions built to industry standards.

Expertise in compliance with financial regulations.

Support for digital banking, payments, and data analytics.

Customized fintech AI agents to streamline your operations.

Examples Of API Banking

1. Account Information APIs

Banks can provide account information APIs that allow authorized third parties to securely access customer account details like balances, transaction history, beneficiary details etc. Customers can view consolidated information from multiple bank accounts in one fintech app. Account APIs enable personal financial management solutions.

2. Payment Initiation APIs

It enables third parties to directly transfer payments from a customer's bank account to any payee, domestic or international, directly through API calls. It facilitates instant payments in e-commerce websites and apps via bank accounts instead of cards and allows a seamless checkout experience.

3. Identity and KYC Verification APIs

Banks provide APIs for identity and KYC verification that allow other providers to validate the identity of customers against bank databases securely and digitally. It eliminates redundant KYC processes, improves onboarding and enhances trust.

4. Customer Analytics APIs

Banks can expose anonymous customer data like transactions, demographics, channel usage etc., to partners via analytics APIs. This data can be used to derive businesses insights, understand consumer behavior, develop credit risk models and personalize offerings.

5. Alerts and Notifications APIs

Alerts and notifications APIs allow banks to send real-time alerts and event-triggered notifications to customer accounts for activities like transactions, rate changes, payment reminders etc. Adds convenience.

6. Product Eligibility and Application APIs

Banks provide information on available products via eligibility APIs so that partners can recommend suitable offerings to customers and apply via application processing APIs for faster product fulfillment.

How Banks Provide Open APIs

Banks have adopted a phased approach to open their systems using open APIs securely. They start by carefully evaluating businesses objectives, customer demand, growth opportunities and competitive landscape to formulate an API strategy aligned with overall goals. Banks assess legacy systems and clean up data to identify functionality that can be exposed as reusable APIs for internal reuse and external third parties. They frame API guidelines covering technology standards, access control, monetization models, developer support etc. Banks create sandbox environments where fintechs can test APIs before launch.

From a technology perspective, banks leverage API management platforms that act as a gateway to expose APIs to partners. These platforms handle tasks like developer/API key management, analytics, throttling, and security tasks. Banks also implement solutions like OAuth2 for secure user authorization and OpenID for federated identity management across entities. APIs are built using industry standards like REST, JSON and HTTPS. Existing APIs are modernized, while new ones are built using agile methods.

Banks publish API documentation portals for developers with details on core capabilities, onboarding process, and support available. Developer engagement initiatives like hackathons and community building further drive adoption. Banks take a phased roadmap approach to open up APIs across key categories like accounts, payments, identity, and security. Monetization models like usage-based pricing and revenue sharing are formulated for commercialization. Banks utilize API analytics tools to get adoption insights.

To ensure reliability, banks implement API gateways, containerization techniques, and automated testing to ensure reliability to ensure reliability. Security and regulatory compliance are maintained through encryption, tokenization, and authentication protocols. Gradually, legacy monoliths get decoupled into cloud-native microservices accessed via APIs. Evolving technologies like AI, blockchain, and IoT will drive the next wave of smart banking APIs. So, a well-planned API platform helps banks embrace openness, innovation and new revenue channels.

Open Banking Initiatives Around the World

The UK has been at the forefront of open banking services, with the Competition and Markets Authority mandating the Open Banking Initiative in 2016. Banks must open up data through APIs, allowing consumers greater financial information transparency and control. The EU followed suit by introducing PSD2 regulation in 2018 to promote innovation in open banking services and payment services.

Australia launched the open banking software regime in 2021, asking other banks to share products and customer data. The Monetary Authority of Singapore has guidelines on finance-as-a-service APIs to spur innovation.

Hong Kong issued Open API frameworks for the banking sector. Brazil, Mexico, Nigeria and India also have open banking frameworks stipulating data sharing and API standards. The US lags in open banking legislation, but some financial institutions provide data access APIs voluntarily. Global partnerships like open banking help Nigeria initiative spread capabilities. So, open banking is gaining momentum globally, driven by open banking regulations, customer demand and digital innovation.

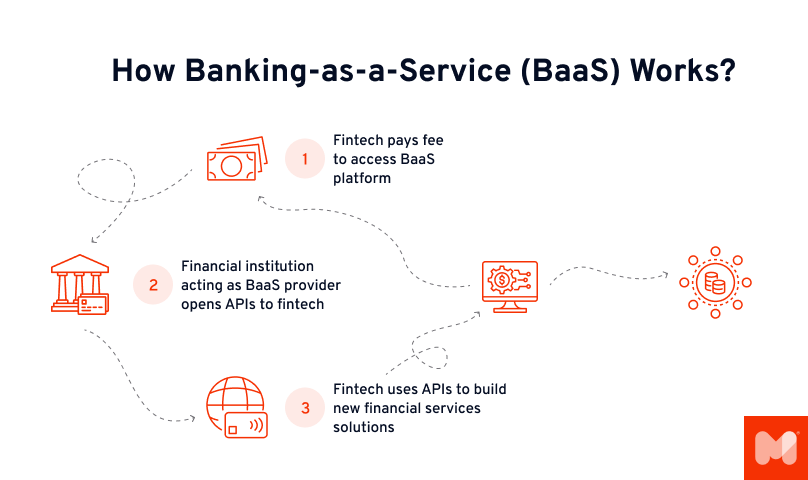

How Open Banking And Bank APIs Are Boosting Fintech Growth

Open banking has accelerated Fintech innovation by providing secure access to customer financial data and bank infrastructure through APIs. Fintechs are leveraging these APIs to build innovative products and improve services in payments, lending, investments, insurance and more. Payment initiation APIs are powering instant bank transfers on e-commerce platforms. Account aggregation APIs help fintechs provide a unified view of a customer's finances from multiple accounts and institutions.

Open banking has enabled new business models like embedded finance, where fintechs integrate financial service providers into non-financial brands. The direct access to bank systems has helped fintechs rapidly scale up their customer base. Banks have partnered with fintechs to improve offerings and reach new segments. The collaborative ecosystem and thriving developer community driven by open banking have accelerated the pace of digital innovation in financial services. Though still evolving, open banking has catalyzed the growth of fintech firms globally by fostering access, innovation and healthy competition.

Figure 3: Open API in Fintech

Importance of Open Banking API security

Open banking has revolutionized financial services by enabling banks to open customer data via APIs to third-party providers. However, this also expands the attack surface for cyber threats if security is not robust. Stringent security is crucial for maintaining trust and integrity across the open banking ecosystem. Banks implement layered security encompassing API gateways, encryption, access control, authentication and authorization protocols like OAuth 2.0 and OpenID Connect to allow only legitimate access. Standard Transport Layer Security (TLS) is critical for encrypting API communication. Tokenization techniques mask sensitive payment information: input validation and threat protection like DDoS defense secure APIs from common attacks.

User consent is central to open banking data sharing. Banks provide interfaces for customers to transparently approve, manage or revoke third-party access to their accounts. Multi-factor authentication (MFA) adds another layer of identity verification. API vulnerabilities are reduced through secure coding practices and extensive testing. Monitoring API traffic for anomalies provides visibility. AI and machine learning further bolster threat detection and prevention capabilities.

With careful API and integration design, banks maintain appropriate segmentation between open banking interfaces and critical backend systems. This isolates and protects core banking functions. Access control policies are finely tuned to grant external apps only the specific roles and data needed. Ongoing API performance monitoring and maintenance detect issues early.

Banks comply with regulations and security standards around customer data confidentiality, retention and governance. Creating strong awareness among consumers regarding privacy practices and risks builds confidence. Fostering collaboration on cybersecurity with fintech partners and regulators is also crucial.

Open banking necessitates a holistic security strategy spanning people, processes and technology. With customers relying on dozens of third-party fintech apps, vigilant security enables trust, innovation and adoption of open banking.

The Regulatory Requirements for Open Banking APIs

Open banking regulatory frameworks mandate banks to provide open APIs for data sharing with customer consent. This enables third parties to build financial applications and services integrated with bank systems.

Regulations like PSD2 (Payment Services Directive) in the EU and open banking initiatives in the UK, Australia and Singapore require banks to provide standardized APIs for account information, payment initiation, and identity verification. Strict customer consent mechanisms must be implemented before providing third-party access.

Banks must comply with specific operational, security and testing criteria set by regulators for open APIs. This includes stipulations around high availability, performance metrics, authentication protocols, risk monitoring and incident reporting. APIs also undergo certification testing and audits for compliance.

Regulations mandate standard standardized API formats based on REST principles and data standards like JSON for interoperability. Rules also govern proportionate access, i.e., third parties should only get access to the specific accounts and data explicitly consented to by customers.

Banks require third parties to register as licensed providers and maintain transparent terms and conditions with customers. Complaint redressal mechanisms must be established.

So, regulations boost customer trust and foster competition in open banking standards by ensuring financial stability, data privacy, and security. However, they also increase compliance costs for banks. Regulatory alignment across jurisdictions can help maximize open banking adoption globally.

Challenges and Concerns with Open Banking

Open banking has many merits but also poses multifaceted challenges for banks. A well-planned strategy and effective risk management are critical to realizing the benefits. Regulators also have a key role to play in addressing concerns. The key challenges/Concerns with open banking are given below in Table 3:

Table 3: Challenges and Concerns

Challenge/Concern | Description |

Security and Privacy Risks | Sharing customer data and access to bank systems expand attack surfaces and risks like data breaches, identity theft and fraud. |

Increased Complexity | Integrating disparate systems via APIs increases technological complexity for banks. |

Implementation Costs | Significant upfront investments are required by banks for API infrastructure, systems integration, and compliance. |

Organizational Resistance | Cultural resistance within banks to adopt open banking and collaboration mindset. |

Regulation Compliance | Compliance overheads to meet evolving regulatory standards for open APIs. |

Legacy Systems | Monolithic legacy systems hinder API adoption, requiring core modernization. |

Talent Shortage | Lack of skilled technical talent to build, integrate and manage APIs. |

Revenue Cannibalization | Banking offerings face competition from fintech API offerings, leading to revenue loss. |

Customer Adoption | Customer awareness, understanding and adoption of open banking remains low globally. |

Fintech Coordination | Managing partnerships with multiple fintechs poses operational challenges for banks. |

Future of Open Banking API

The future of open banking APIs is expected to grow exponentially as more banks digitally open up data and services digitally. Increasing regulatory mandates will expand API adoption across jurisdictions. Customers will get more control over financial data, fueling innovative services from fintech and big tech firms collaborating via APIs. APIs supported by Artificial intelligence will enable intelligent financial assistants and hyper-personalized banking.

Data sharing between banks, telcos, e-commerce, and other sectors via financial APIs standards could birth innovative converged offerings. According to the UK institution OPEN BANKING, only in the UK open banking framework has reached an outstanding milestone, achieving 11.4 million payments in July 2023. Leading executives said:

“It is fantastic to see how many consumers have benefited from open banking since the Competition and Markets Authority’s Retail Banking Market Investigation Order was issued in 2017. Open banking has transformed the way millions of people manage their money and today’s announcement is further evidence of the significant progress that has been made since 2017.”

Sarah Cardell, Chief Executive of the CMA

The strong and sustained growth in open banking payments underscores the rapid pace at which open banking is reshaping the financial and payments landscape. It reinforces the pivotal role open banking plays in driving financial inclusion, innovation, and consumer empowerment.

As open banking continues to redefine the way people manage their finances, the doubling of total payments in just one a year is a remarkable achievement and testament to the transformative impact of open banking.

Marion King, Chair and Trustee of Open Banking Limited

Moreover, the future can be built on blockchain-based smart contracts that have the potential to automate payments initiated via APIs. However, customer privacy, security, transparency, and financial stability must be addressed amidst this disruption.

With APIs powering the Internet of Banking, incumbents who transform rapidly will shape the future landscape. Open banking is poised to leapfrog banking into an era of embedded, intelligent and instant financial services industry.

Conclusion

In conclusion, open banking APIs transform financial services by enabling banks to open customer data and services to third parties securely. It fosters innovation, increasing personalization and expanding customer choice. However, open banking practice also brings challenges like security risks, implementation costs and organizational resistance that must be managed. Overall, open APIs powered by regulatory frameworks represent a paradigm shift towards open and collaborative banking. They are unleashing exciting new possibilities for consumers, fintech disruptors, incumbents and the broader digital economy. With the continued evolution of enabling technologies like AI, blockchain and 5G, open banking has the potential to reshape finance as we know it in the years ahead. However, Pragmatic policymaking and solutions that build public trust will determine the ultimate success of this disruption.

Fintech and Financial Software Development Insights

Are you intrigued by the rapidly evolving world of fintech and financial software development? At Mobile Reality, we take pride in our extensive knowledge and experience in this dynamic field. We navigate complex challenges, implement innovative strategies, and develop groundbreaking solutions in fintech. Our carefully curated selection of articles offers in-depth perspectives on key aspects of fintech and financial software development:

- Top Fintech Conferences That You Cannot Miss in 2025

- Leveraging Blockchain for Fintech: A Look Ahead to 2025

- Top 5 Wealth Management Solutions in 2025

- Top 10 Best Investment Apps for Business in the US

- AML KYC Simplified: Best Practices for Fintech Apps

- Building an MVP for fintech and modern banking

- Fintech Week NYC: Key Trends and Transformations

- Digital Product Design for Fintech Market

- Top Investment Apps in Europe in 2024

- TOP 10 KYC & AML software companies in 2023

- The Future of Financial Services: AI for Fintech

- Explore the Future of Fintech App Development in 2025

Explore these comprehensive resources to deepen your understanding of the fintech sector. If you have any questions or are interested in exploring partnership opportunities in fintech software development, please contact our sales team. For those aspiring to join our innovative team, visit our careers page to submit your CV. Join us in driving the future of fintech and financial software development!