AI Agents for Fintech Innovation

Lead the financial future with our advanced AI agents for finance and automated decision-making systems. As your partner in financial innovation, we build AI-driven fintech solutions tailored to the unique needs of financial institutions and fintech startups.

From fraud detection to investment analysis, our AI agent development process delivers secure, scalable, and intelligent automation. Harness predictive analytics, real-time data, and smart assistants to transform your financial operations and empower faster decisions.

Case studies

Explore our AI-driven fintech case studies to see real-world examples of innovation. From virtual assistants to predictive analytics, discover how we empower clients with custom-built AI tools for growth and efficiency.

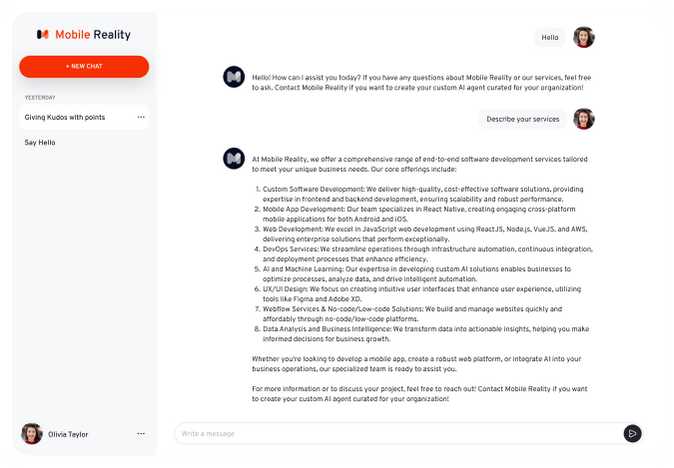

Meet the Mobile Reality AI Assistant!

Your smartest guide to everything about Mobile Reality – our custom software development services, tech expertise, pricing and company insights. Ask anything about our fintech, proptech, blockchain and music software solutions, and get instant answers from our AI-powered assistant!

💡 Discover Mobile Reality like never before – try it now!

Chat with Our AI AssistantTailored AI Agent Solutions for Fintech

Achieve your business goals with our state-of-the-art AI agent development expertise, crafted for fintech and banking innovation. Our scalable AI platforms, powered by LLMs and advanced algorithms, are tailored to automate complex workflows and decision-making. We specialize in full-stack custom AI solutions for finance, including backend, frontend, and cloud-based agents. Count on us to apply cutting-edge frameworks that deliver intelligent automation in fintech.

You’re in expert hands as we deliver transformative AI solutions to financial firms, driving intelligent automation and reshaping banking processes. We empower fintech startups and mature companies with AI-powered financial agents. Let us support your growth with tech that adapts, learns, and scales to your digital vision.

Strategic AI Consultation for Financial Services

Navigating today’s AI-driven fintech space requires deep technical insight and strategic guidance. Our AI consulting services are designed to uncover opportunities, manage risk, and chart a smart path forward. We collaborate closely to understand your financial workflows, goals, and data challenges—building AI roadmaps aligned with your needs and compliance standards.

Our approach to AI strategy is hands-on and end-to-end. We help implement AI-powered financial agents that integrate with your existing platforms and legacy systems. Whether you’re launching a new AI assistant, enhancing fraud detection, or automating compliance, we guide your fintech transformation—from planning to deployment—with full accountability.

Where AI Agents Create Real Value in Finance

Automated Fraud Detection & Risk Monitoring

Combat financial fraud with real-time AI-powered agents that detect anomalies, flag threats, and adapt to new risks. Our AI agent development services build secure, self-learning systems that enhance transaction monitoring and protect your financial infrastructure against evolving cyber threats.

Personalized Finance Through Intelligent Automation

Enhance your client experience with AI agents that deliver tailored financial recommendations, automate onboarding, and offer 24/7 smart support. Our intelligent systems boost user satisfaction and streamline digital workflows, giving your services a competitive edge in financial innovation.

Smarter Investment Decisions with AI Insights

Use AI agents to synthesize vast data sources and provide real-time investment guidance. From market sentiment analysis to asset risk scoring, we develop tools that power AI-assisted financial strategies—enhancing returns and decision accuracy across portfolio management.

AI-Powered Agents to Transform Operations

Accelerate internal workflows with AI-driven agents built for financial process automation. Our solutions reduce human error, optimize compliance, and enable predictive reporting. Whether supporting advisors or back-office teams, we design AI agents to boost productivity across your organization.

Why Should Your Finance Company Use AI Agents?

In today’s fast-evolving fintech landscape, AI agents are essential to scale operations and improve outcomes. As AI consultants, we help you leverage LLM-based financial agents for automation, insight generation, and user experience enhancements. Partner with Mobile Reality, a leader in AI-powered fintech development, to harness intelligent systems that reduce costs, enhance service, and future-proof your digital strategy.

Anticipate Customer Behavior

Use machine learning and AI agents to anticipate client behaviors and deliver personalized financial experiences.

Create Smarter Banking Interactions

Combine intelligent UIs and NLP-powered chatbots with guidance from our AI strategy experts to elevate your digital product.

Safeguard Sensitive Data & Compliance

Safeguard data and ensure AI governance through our secure AI development lifecycle for fintech.

Streamline Finance Operations

Deploy financial AI agents to analyze key metrics, reduce manual work, and enhance agility across fintech operations.

Matt Sadowski

CEO of Mobile Reality

Revolutionize Your Financial Services with AI Agent Solutions!

Empower your business with cutting-edge software designed to enhance customer experience, streamline operations, and ensure compliance.

- Free consultation for bespoke fintech solutions

- Explore how custom software can drive efficiency and growth in the financial sector

- Expertise in digital banking, payment processing, and investment platforms

- Enhance security and compliance with advanced technologies

- Optimize financial operations with data-driven insights

Why AI Agents in Finance?

Deploying AI agents in fintech is reshaping the industry through intelligent automation, real-time data analysis, and enhanced decision-making. Here's how LLM-based AI agents transform customer service, compliance, and insights for financial companies:

AI Assistants for Better Customer Engagement01

LLM-based AI assistants understand natural language and respond to client queries instantly, enabling smarter support via virtual agents. These AI-driven solutions handle routine requests, assist with transactions, and offer personalized financial advice. Over time, AI agents adapt and refine their accuracy, offering a responsive and seamless user experience 24/7.

AI Agents for Document Automation03

Generative AI for finance reads contracts, loan files, and KYC data to extract insights and speed up workflows. Our agents handle parsing, validation, and smart annotation of financial documents—freeing teams from repetitive tasks. These tools improve data accuracy, reduce approval cycles, and enhance strategic decisions based on deep document intelligence.

Automated Compliance & Fraud Monitoring02

AI agents for compliance analyze regulatory text and transaction logs to flag anomalies, detect fraud patterns, and ensure real-time compliance. LLMs automate monitoring and accelerate response times to suspicious activity, reducing the reliance on manual reviews. This results in safer, faster, and more accurate financial oversight across the organization.

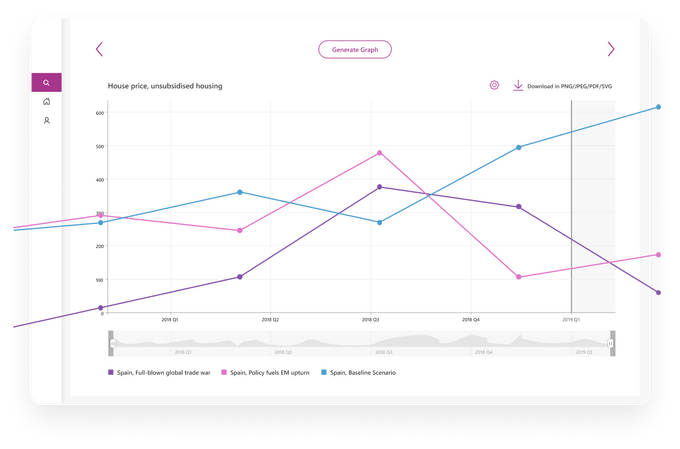

Predictive Analytics & Intelligent Forecasting04

AI agents synthesize large data sets and external inputs to provide predictive insights. By using LLMs to analyze structured and unstructured data, they identify trends, assess creditworthiness, and refine investment strategies. These insights empower financial institutions to personalize services, boost ROI, and navigate market volatility with confidence.

Whether you're a fintech startup, digital bank, or global finance firm, our expertise in AI agent development ensures seamless integration with your systems. Contact us today to explore how we can build tailored AI agents that redefine your fintech operations.

What AI-Driven Systems Can We Build For You?

Security

Our AI agents help detect fraud and unusual patterns, enhancing financial infrastructure security with continuous monitoring and real-time alerts tailored for modern banking systems.

Assurance

Our AI-based audits and predictive tools deliver data-backed insights and recommendations. Trust our expertise to identify pain points and deliver intelligent solutions for your organization.

Efficiency

Maximize operational output with AI automation tools that minimize errors, accelerate processes, and ensure smooth internal collaboration within your teams.

Compliance

Use our AI-powered tools to stay compliant in real time. We integrate regulatory updates and risk checks into automated compliance workflows tailored for finance.

Innovation

Stay ahead in fintech by deploying AI-driven innovations. We develop custom agents trained on your data to power smarter products, decisions, and user experiences.

AI Agents for Fintech & Banking

AI for Trading Platforms

Our AI development team builds agent-based trading systems that interpret real-time market data and execute logic-driven trades. We simplify financial tool UX and integrate predictive analytics to help financial firms automate decisions. Interested in building your AI-powered trading platform? Contact us or fill out our project form.

AI in Financial Planning & Management

We build smart financial management tools powered by generative AI and automation. These systems optimize budgeting, expense analysis, and strategic planning. Want to build yours? Contact us or use our estimate form.

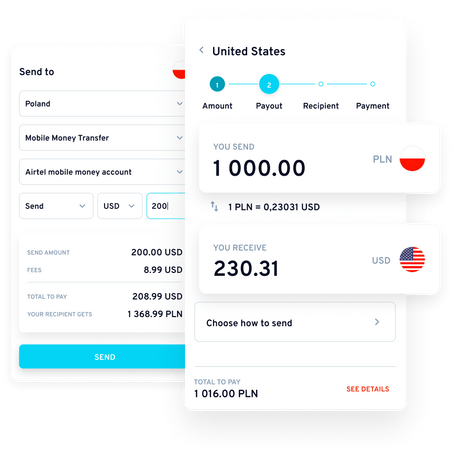

AI-Powered Payment Systems

We specialize in AI-enhanced payment solutions for real-time fraud detection, adaptive routing, and personalized user flows. Whether B2B, mobile, or e-commerce focused, we build secure, efficient systems. Reach out or use our project form to get started.

Frequently Asked Questions

Opting for custom fintech software development offers numerous advantages tailored to your unique business goals, rather than the generalized solutions provided by subscription-based SaaS tools. Custom development enables you to create platforms that cater specifically to your needs and those of your clients, offering unique features that provide a competitive edge in the dynamic fintech industry. This approach ensures you can build scalable solutions that grow with your organization and adapt to changing market demands. With custom software, you have complete control over data, features, and the overall system, ensuring strict adherence to regulatory compliance and enhanced security protocols for sensitive financial information. A custom approach enhances user experience and branding, increasing customer satisfaction and loyalty.

Additionally, seamless integration with existing systems and the development of robust APIs improve interoperability and operational efficiency. Although custom development requires an upfront investment, it eliminates ongoing subscription costs and can be more cost-effective in the long term. Dedicated support and development teams ensure proficient system maintenance and enhancements, optimizing performance and aligning with your evolving strategies and market conditions in the fintech sector.

Several factors, including the complexity of features, integration needs, security measures, and regulatory compliance requirements, influence the cost of banking app development. One increasingly popular approach in the industry is Banking as a Service (BaaS), which allows traditional banks and fintech companies to leverage third-party services to build their digital banking platforms. Integrating BaaS can reduce development time but may increase upfront integration costs depending on the services and APIs involved.

To accurately assess the cost of banking app development, starting with a product development workshop is essential. During this workshop, we identify all the necessary features, unique selling propositions (USPs), regulatory limitations, integration requirements, and security measures tailored to your app. This initial phase allows us to provide a more precise cost estimate and ensure the final product meets your business goals and compliance standards.

Mobile Reality's banking app development services typically range from $45 to $65 per hour of software engineer work, with UX/UI design and QA services available at $42,5 to $52,5 per hour. Additional factors like BaaS integration, advanced security protocols, and ongoing maintenance can influence the overall cost. However, by conducting a thorough workshop at the start, we ensure a well-planned, cost-effective development process that delivers a high-quality, secure banking app.

If you’re interested in exploring the potential costs and strategies for your banking app, we recommend scheduling a consultation to discuss your specific needs. Moreover, to get a more tailored estimate, you can fill out our Estimate Project Form. This form helps us better understand your project requirements, allowing us to provide you with a detailed and accurate cost estimate.

Mobile Reality has developed several notable custom fintech solutions:

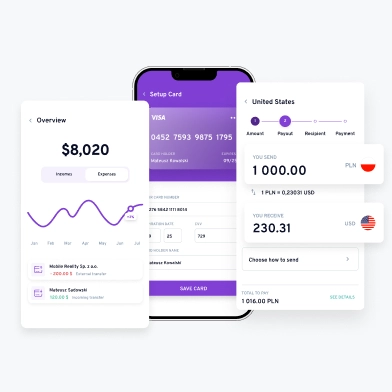

Money Transfer Software: We created a robust, secure platform enabling seamless international money transfers with real-time tracking and compliance features. Learn more.

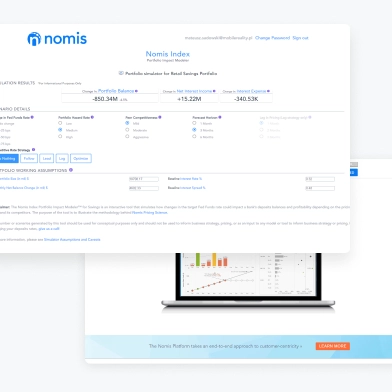

Banking System Software: We developed a comprehensive banking solution for Nomis Solutions, focusing on customer-centric pricing and profitability management with features like savings deposit simulators and transaction logging. Learn more.

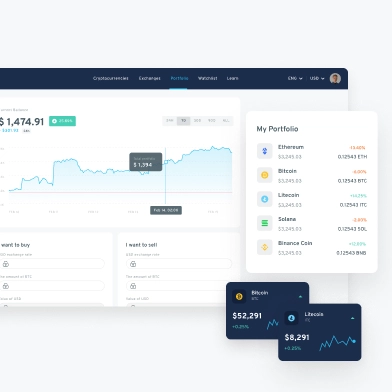

Cryptocurrency Exchange Software: Our platform facilitates secure and efficient cryptocurrency trading, incorporating elements of decentralized finance, with advanced features such as real-time market data and wallet management. Learn more.

Customer Churn Prediction Software: Using machine learning, we built predictive analytics and financial technology software to help businesses identify and retain at-risk customers based on their financial data. Learn more.

Sports Betting Tips App: We developed an app that provides users with predictive sports betting tips based on statistical analysis and real-time data. Learn more.

Each project demonstrates our commitment to delivering innovative, tailored fintech solutions that meet our clients' needs.

We are a full-stack JavaScript software development company specializing in web app development using ReactJS or VueJS for the front end, NodeJS for the backend, and AWS for cloud solutions. For mobile fintech app development, we use React Native for cross-platform compatibility. Our web design tools include Figma and Adobe XD. For QA services, we use Xray and TestRails.

Mobile Reality offers several advantages as a fintech digital solutions provider:

Geographical Advantage: As a Polish software development company, Mobile Reality is part of a region known for high-quality software development services and IT expertise.

Competitive Pricing: Financial software development costs related to the services are between $45 and $65 per hour, with UX/UI design and QA services available at $40 to $50 per hour, providing an attractive balance between cost and quality.

Inclusive Project Management: Project management costs are typically included within the overall development team cost, leading to a more streamlined and cost-effective service package for building new financial software development solutions.

These advantages make Mobile Reality a reliable and cost-effective choice for fintech software development.

We start financial software development projects with a product design workshop to define the features and technical aspects of your desired fintech solution. This phase helps us understand the APIs to integrate and create initial UX/UI designs, allowing us to provide examples and estimates of workload and cost.

After the workshop, we can proceed with a fixed-price or time-and-materials cooperation model, depending on your preference. The fixed-price model offers a stable scope, deadline, and budget, while the time-and-materials model allows for greater flexibility.

At Mobile Reality, we suggest the following cooperation flow in fintech project:

Daily internal meetings with the presence of the client's representatives and our project/delivery manager.

Everyday communication to clarify scope and features.

Weekly status meetings between the client and Mobile Reality.

Demonstration of the system after significant scope implementation.

Daily communication on Slack channels with ad-hoc meetings to address issues.

After releasing the app, we recommend our SLA support service and a software maintenance agreement for ongoing improvements and changes. Our support includes:

Availability: 24-36 hours per month dedicated to on-demand improvements and updates.

Critical issues: Response time of 1 business hour and resolution time of 8 business hours.

Standard issues: Prompt attention to ensure your app remains functional and up-to-date.

These services ensure your app runs smoothly and efficiently post-launch.

We have a team of 25 experienced fintech software developers and specialists, including QA specialists, UX/UI/graphics designers, and product and project managers. Our team size is flexible and adapts to the specific needs of each project, ensuring we have the necessary resources to deliver on time and within budget.

AI in Fintech Hub

Welcome to our AI-powered Fintech Hub—your source for insights into AI agent development, predictive modeling, and LLM applications in finance. Discover how Mobile Reality is shaping the future of digital finance with innovative, data-driven technologies.

01.10.2025

Top 10 Fast-Growing Fintech Companies in the US in 2025

Discover our annaual report from the european market - the top 10 fast-growing fintech companies in the US for 2025. Stay ahead of the curve.

Read full article

29.07.2025

Top 10 Fast-Growing Fintech Companies in the EU in 2025

Discover our annaual report from the european market - the top 10 fast-growing fintech companies in the EU for 2025. Stay ahead of the curve.

Read full article

13.06.2025

Top 10 Fast-Growing Fintech Companies in the UK in 2025

Discover our annaual report from the UK market - the top 10 fast-growing fintech companies in the UK for 2025. Stay ahead of the curve.

Read full article

Break the rules! Be Mobile!

Request a call today and get free consultation about your custom software solution with our specialists. First working demo just in 7 days from the project kick‑off.

Matt Sadowski

CEO of Mobile Reality