Clients Churn ModelPowering Financial Success with Churn Prediction Software

In the dynamic realm of financial technology, customer retention and churn management are paramount. Our project, the Client Churn Model for Payment Processing Solutions, exemplifies the crucial role of advanced customer churn prediction software in the financial sector. With millions of global customers across diverse markets, our client sought to harness data analysis, predictive analytics, and automation to create efficient churn prediction models. By doing so, we enabled them to make data-driven decisions, elevate customer satisfaction, and maintain their position as a global leader in payment processing in 2024. Discover how data-driven strategies are shaping modern businesses, fostering loyalty, and driving sustainable growth in this competitive landscape.

Scope of work

Data Analysis

R

Python

AWS Cloud

About Customer Churn Prediction Software

Our client, a fintech company with over 2 million global customers in 36 countries, sought to enhance customer retention using advanced customer churn prediction software. With a diverse customer base spanning 131 currencies, the challenge was clear: retain customers in a highly competitive market while under pressure from revenue issues due to low profitability and demand for loans.

Challenge: Navigating Vast Data and Limited Time

The heart of our project lay in surmounting the formidable challenge of managing extensive data volumes and meeting tight deadlines head-on. It was imperative to handle millions of data points and intricate customer behavior records with utmost precision. This called for a meticulous approach to data analysis and the creation of predictive churn models that could adapt to the dynamic nature of the financial sector.

Expertises

Data Analysis

Location

Germany

Main Goals: Driving Precision and Customer Retention

At the core of our mission were two primary objectives, each interwoven with precision and customer retention. Our foremost goal was to deliver a top-notch service that surpassed client expectations. We were unwavering in our commitment to showcasing the unparalleled accuracy of our churn prediction software. Even when confronted with the intricacies of vast data volumes and stringent deadlines, our team remained resolute in our pursuit of delivering pinpoint solutions that resonated with our client's needs.

In parallel, we directed our efforts towards an equally crucial mission: aiding our client in navigating the challenges of churn risk mitigation. Our strategies were laser-focused on enhancing the overall customer experience and fortifying customer retention. Through the implementation of data-driven methodologies and the power of predictive analytics, our approach harmonized with the client's overarching business objectives. Our contribution extended far beyond the project's timeline; it was a steadfast investment in our client's long-term prosperity.

In the dynamic landscape of the financial sector, where every decision counts, our commitment to precision and unwavering support for customer retention became guiding principles. By aligning our strategies with data-driven insights and the potential of churn prediction models, we propelled our client towards enduring success, creating a legacy of trust and value in the realm of financial technology.

Solutions: Harnessing Cutting-Edge Technology for Churn Prediction

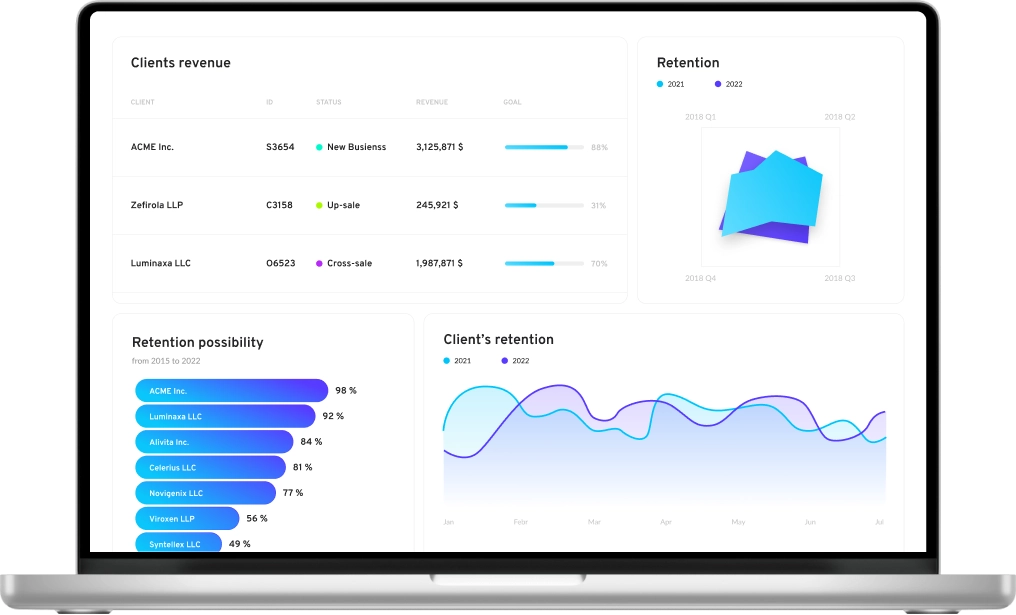

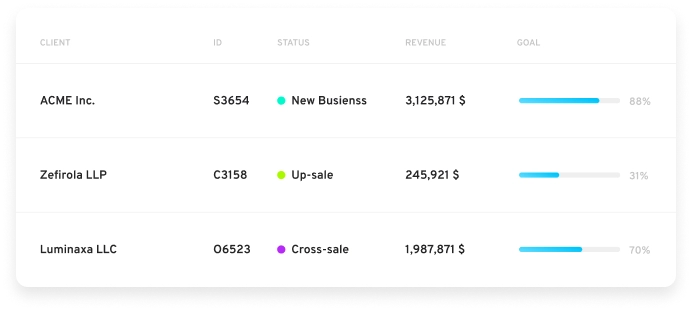

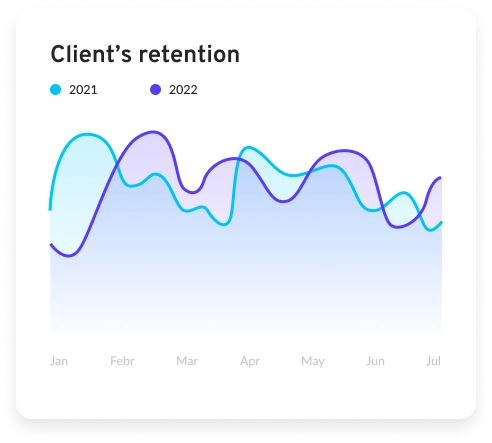

Our project thrived on innovation, employing cutting-edge churn prediction software and predictive churn models to tackle the complex challenge at hand. We initiated with comprehensive data mining across three diverse databases, crafting approximately 200 variables to enhance accuracy. The efficient utilization of advanced churn prediction software for 2024 enabled us to navigate vast datasets seamlessly, managing millions of rows with precision.

Automation was key to our success, streamlining the entire workflow from data import to swift export into external databases. This automation not only optimized operations but also facilitated the creation of distinct churn prediction models tailored for five unique markets. Our commitment to innovation, predictive analytics, and agile software solutions solidified our position as a top provider of churn prediction solutions, empowering our client to thrive in the evolving landscape of customer churn management.

In today's data-driven world, our expertise in deciphering customer interactions, predicting churn risk, and supporting customer success teams positions us as a leading provider of prominent churn prediction software. As businesses evolve, our dedication to technological innovation ensures we remain a valuable asset for navigating the intricacies of churn management and fostering lasting customer relationships in the modern era.

Summary

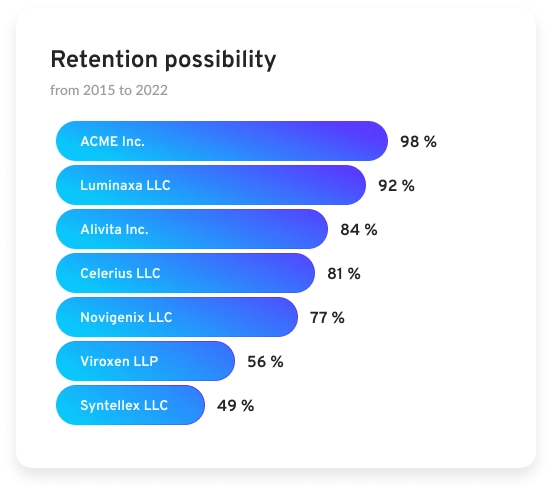

In a rapidly evolving market, our client relied on top churn prediction solutions to optimize customer experience and identify potential churn risks. By influencing customer churn using state-of-the-art churn management platforms and customer retention strategies, we paved the way for modern customer churn prevention. Our expertise in machine learning and predictive modeling empowered the client to proactively manage customer relationships, extract valuable insights from customer data, and boost customer lifetime value.

In conclusion, our project showcased the essential role of customer churn prediction software and predictive churn analytics software in today's business landscape. Our client, like many other SAAS companies, recognized that the success of their customer success teams relied on data-driven decisions, powered by artificial intelligence and predictive churn analytics software. We are proud to be a part of their journey toward efficient churn management, driving loyalty and growth in their customer base with our tailored software solutions.

For businesses seeking the top 10 churn analysis tools and software solutions in 2024, our experience with prominent churn prediction software and tools is a testament to the efficiency of our service. We understand the reasons for churn and are committed to providing the most efficient churn prediction software in the market.

Contact us to learn more about how our predictive churn software can enhance your customer relationships, reduce churn rate, and boost your business's success in the competitive landscape of 2024.

Break the rules! Be Mobile!

Request a call today and get free consultation about your custom software solution with our specialists. First working demo just in 7 days from the project kick‑off.

Matt Sadowski

CEO of Mobile Reality

Case studies

Explore our past successes and see our expertise in action with our fintech case studies. Discover how we've helped financial industry drive growth and success from mobile apps to data analysis.