Nomis IndexNomis Index - Customer-centric Pricing and Profitability Management

In the competitive fintech sector, Nomis Solutions' "Nomis Index" redefines retail banking with its advanced pricing and profitability tools. This case study delves into the partnership between Nomis and Mobile Reality, showcasing the creation of an MVP that elevates the banking experience. Explore how we blended Node.JS and React.JS development with user-centric design to deliver a robust banking software solution that enhances strategic decisions and market responsiveness for financial institutions. Discover the innovation behind the Nomis Index, where customer focus meets cutting-edge technology.

Scope of work

Web development

Node JS

React JS

UX/UI Design

AWS Cloud

Pioneering in Retail Banking Solutions

Client Background: Nomis Solutions, a distinguished name in the fintech sector of the United States, is lauded for its trailblazing approach to retail banking. They are experts in customer-centric pricing and profitability management, crucial components of contemporary banking systems.

Service Provider: Mobile Reality, acclaimed for its mastery in crafting banking system software, collaborated with Nomis Solutions to forge a transformative banking solution.

Main Goal: The central aim of this endeavor was to conceive a Minimum Viable Product (MVP) for banks, with a focus on modernizing and refining the web versions of Nomis Solutions' offerings. This ambitious project demanded profound insights into banking software, a challenge Mobile Reality met with aplomb.

Web Development: By leveraging Node.JS and React.JS, we sought to rejuvenate the online banking experience, ensuring alignment with the pinnacle of digital banking and core banking solutions.

UX/UI Design: Our goal was to enhance the banking platform to be as user-centric as possible, guaranteeing that both clientele from traditional banks and modern digital banking institutions would find the interface to be intuitive and easily navigable.

Implementing Top Core Banking Software Under Tight Deadlines

Faced with stringent time constraints, our team was tasked with the integration of sophisticated banking systems software, which included the development of CSV parsing for domain names and bank default parameters. Additionally, we were charged with the creation of a deposit simulator, engineered as a static HTML app with a responsive design, a vital element in the array of retail banking products. Our multifaceted strategy comprised:

Expertises

Fintech & Banking

Location

USA

Tailored Banking Software Solutions

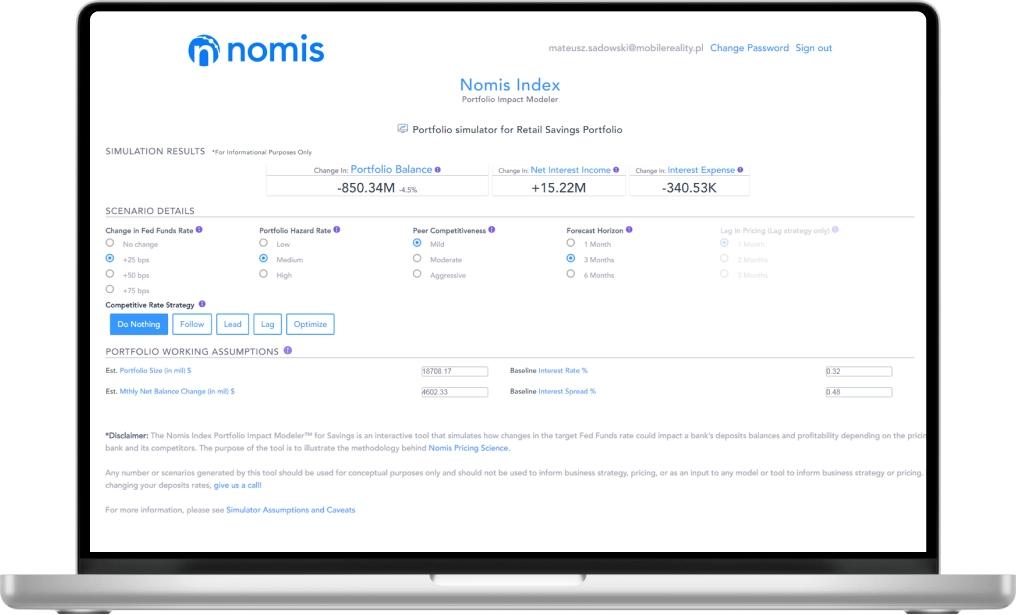

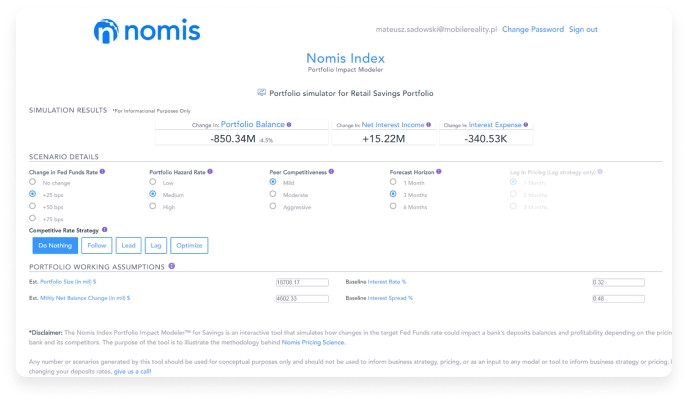

The Nomis Index app is a sterling example of retail banking software, meticulously crafted by Mobile Reality to cater to the dynamic needs of the banking industry. The UI is a paragon of the latest in banking system software, facilitating a digital banking experience that is both intuitive and comprehensive. The software offers a retail banking solution that distinguishes itself among banking software solutions with its modern aesthetic and sophisticated color scheme that promotes user engagement.

Attuned to the requirements of banks and their patrons, the Simulation Results feature stands out in this banking software, showcasing pivotal financial metrics with outstanding clarity. This dashboard is a linchpin in the core banking experience, enabling swift and informed strategic decisions.

Every component of the banking systems software, from Scenario Details to Portfolio Hazard Rate, and Peer Competitiveness metrics, is engineered to bolster banking solutions in strategic planning and market analysis. The application provides robust online banking tools, with features like adjustable Fed Funds Rate and Forecast Horizon, marking it as a contender among the top 10 banking software for its functional depth and user experience.

The banking solution also integrates projections for retail banking products, such as portfolio size and net balance changes, essential for financial forecasting. The app serves as an interactive tool for capital banking solutions and online banking solutions, emphasizing its strategic planning capabilities.

Delivering Complete Retail Banking Solutions

Updating Web Versions: In keeping with the evolving banking software features, we updated the client's product to ensure compliance with the standards of the best banking systems software.

Post-Update Support: Beyond the initial update, we committed ourselves to meticulous bug fixing and ongoing enhancements, indicative of the excellence upheld by top banking software providers.

Summary

Our client, Nomis Solutions, sought a compact yet potent iteration of their existing analytics tools for banks. Despite the project's challenges, Mobile Reality delivered a robust and technologically sophisticated product. Our adherence to deadlines and proactive stance in effecting changes established a new benchmark in banking software reviews.

This partnership with Nomis Solutions has not only reinforced Mobile Reality's status as a pivotal entity among banking software companies but also demonstrated our capacity to deliver integrated banking software that aligns with the evolving demands

Break the rules! Be Mobile!

Request a call today and get free consultation about your custom software solution with our specialists. First working demo just in 7 days from the project kick‑off.

Matt Sadowski

CEO of Mobile Reality

Case studies

Explore our past successes and see our expertise in action with our fintech case studies. Discover how we've helped financial industry drive growth and success from mobile apps to data analysis.