Introduction

Wealth management systems are a critical component for achieving financial success and enabling the growth of assets over time. Digital solutions and applications are increasingly important as technology transforms people's money management. With a range of wealth management apps and wealth manager software now available, it can be challenging to determine which options provide the ideal combination of features, value, and usability for each person's unique needs and goals.

Individuals can make informed decisions by comparing the key factors that enable effective software for wealth management and the criteria for selecting quality apps in today's market. This guide will explore the top considerations for wealth management software 2025 and a list of the top 5 highest-rated software wealth management solutions and applications. With the correct information and analysis, choosing an optimal wealth management software can provide convenient, automated, and strategic financial management capabilities for both short-term expenses and long-term investments.

Key factors of successful Wealth Management 2025

In today's digital era, wealth and investment require a multi-faceted approach to achieve financial advisor goals and maximize the growth of assets. Some of the most critical factors to evaluate include

Easy-to-use interface and tools: For wealth management apps to provide value, the interface and tools should be intuitive and easy to navigate. User-friendly design makes monitoring financial accounts simple, financial software solution utilizing analysis features, executing trades, and accessing automated services. Complex apps with a steep learning curve tend to get abandoned, so optimizing for an engaging and convenient user experience is critical. According to GoodFirms, the top reasons that compel a visitor to leave a web app or website are: slow loading, non-responsive website, or bad navigation, which proves that an easy-to-use interface is crucial to keep users engaged nowadays.

Figure 1: Top reasons that compel a visitor to leave a website | Source: GoodFirms

Automated investing and portfolio management: Quality wealth management isn't just about investment returns—it also requires planning for financial software solution goals like retirement plan, college savings, and insurance needs. Including services like financial planning and one-on-one financial advisor access, and personalized recommendations help create a complete wealth management solution, financial planning software, and financial planning tools. To enhance security in these financial transactions, integrating fintech identity verification can help protect clients' sensitive information and ensure compliance with regulations.

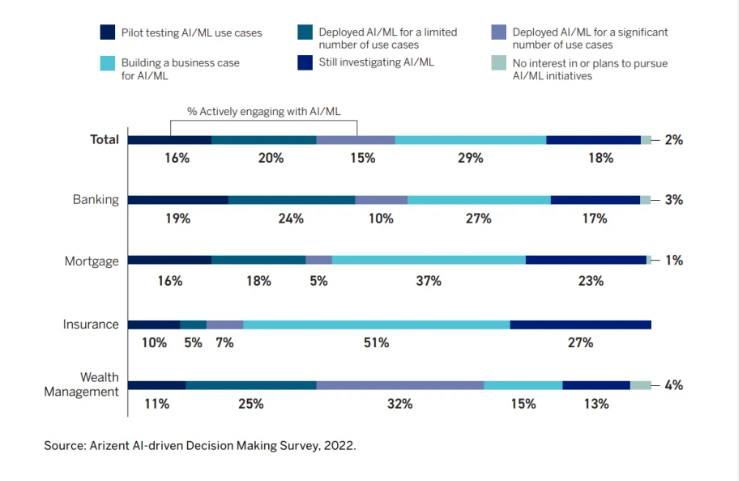

Moreover, the importance and adoption of AI tools in wealth management are becoming increasingly evident. According to a study highlighted by financial-planning.com, 68% of wealth management organizations are utilizing AI tools to aid in their decision-making processes. A notable 32% of them report AI use for a significant number of cases. This is in stark contrast to other industries; for instance, banking saw only 10% of its respondents claim AI usage for a significant number of cases. The insurance and mortgage sectors lag even further behind at 7% and 5% respectively.

The dedication of wealth management to technological advancements is particularly impressive given the diverse range of firms, both small and large, that participated in the survey. These participants represented seven different types of wealth management firms, spanning companies with assets under management ranging from less than $100 million to $2 billion or more.

Interestingly, while a significant number of firms have embraced AI, there's still a portion that remains hesitant. Among the 47% of firms that aren't actively incorporating AI and machine learning, 29% of all respondents indicated that their firms are still in the process of building a business case for its use. Another 18% are still investigating the potential of these tools. A small fraction, only 2%, mentioned they have no interest in exploring the technology whatsoever.

Figure 2: Wealth management leads the way | Source: https://www.financial-planning.com/

Financial planning and advisory services: Quality wealth management isn't just about investment returns—it also requires planning for financial software solution goals like retirement plan, college savings, and insurance needs. Including services like financial planning and one-on-one financial advisor access. and personalized recommendations help create a complete wealth management solution, financial planning software, and financial planning tools.

Security of accounts and data: With wealth management apps storing sensitive financial information ranging from account logins to tax documents, security is mandatory. Encryption, access controls, and features to prevent fraud/hacking should be included, along with measures to ensure user data privacy.

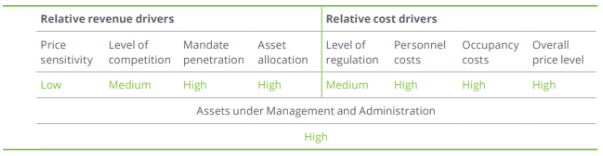

Low fees and costs: Minimizing wealth management fees preserves portfolio returns over the long run. Apps should be evaluated based on their fee structure, including the management expense ratio for investment accounts, trading commissions, account minimums, and other applicable costs.

Figure 3: Low costs in wealth management | Source: Delottie

By prioritizing these critical elements of effective wealth management, individuals can narrow down the apps most capable of optimizing financial growth in the modern era. However, due to the vast number of apps available today, further criteria are needed to select the standout options.

Criteria for a unique selection of wealth management apps

With hundreds of wealth management applications on the market, narrowing down the choices requires an evaluation of the characteristics that set the top apps apart, including

User-friendly and intuitive design: Simplicity and ease of use should be apparent from the initial signup through user experience. The ability to clearly monitor financial snapshots and seamlessly execute critical tasks are hallmarks of quality design.

Customizable investment options: Pre-built portfolios based on risk tolerance are good starting points, but customization provides greater control. The ability to select individual stocks/funds, automated rebalancing, and dividend reinvesting enables personalized investing strategies.

Advanced analytics and tracking: In-depth analysis helps optimize wealth management strategies. Top apps provide tracking of asset allocation, portfolio performance, tax implications, financial goals, and more. Advanced analytics with robust visualization tools empower better decision-making for clients clients clients.

Available account types and offerings: The account offerings should align with each investor's needs, including IRAs, trusts, joint accounts, and more. Features like savings accounts, banking/debit cards, and loans within the app provide convenience.

Customer support and transparency: Wealth management spans critical financial decisions, so customer service is vital. Top-rated apps like betterment and wealthfront provide thorough social support resources, transparent pricing and disclosures, and educational tools to guide investors and business.

Figure 4: Wealth management Apps customer support | Source: Social Graph

This focused criteria enables the selection of elite wealth management apps and wealth management software vendors that meet today's digital financial landscape and portfolio management systems . By comparing options based on these attributes, individuals can determine which apps best fit their customized investing approach, life stage, and wealth management style.

List of top 5 wealth management apps and solutions

With a comprehensive, criteria-based approach for evaluating wealth solutions management offerings, the top 5 highest-rated apps that provide an optimal blend of value, features, and service are:

Matt Sadowski

CEO of Mobile Reality

Fintech Software Development Tailored to Your Needs

We specialize in delivering reliable and compliant software solutions for the financial industry, designed to meet your specific requirements.

Comprehensive development for fintech systems and financial services.

Secure and scalable solutions built to industry standards.

Expertise in compliance with financial regulations.

Support for digital banking, payments, and data analytics.

Customized fintech AI agents to streamline your operations.

1. Betterment

Betterment provides goal-based automated investing powered by advanced algorithms and optimized for taxes. Features include mobile access, portfolio analysis tools, and financial advisors. Account options range from IRAs to trusts, with management fees from 0.25% to 0.40%. Betterment offers a user-friendly experience and robust, customizable automated wealth management.

Figure 5: Betterment

2. Wealthfront

Wealthfront emphasizes automated investing with advanced tax optimization strategies. It offers goal-planning features and financial advisory services provided by real CFPs. Wealthfront provides an intuitive interface, detailed performance analysis tools, and added convenience via account transfers. Management fees start at only 0.25%.

Figure 6: Wealthfront

3. Empower

Empower combines digital wealth management tools with live advisors. It provides real-time net worth tracking powered by secure aggregation of financial accounts. Services range from portfolio monitoring to retirement planning with comprehensive analysis. Personal Capital offers a free basic service alongside its advising services with fees from 0.49% to 0.89%.

Figure 7: Empower

4. Acorns

Acorns makes investing easy and accessible with automated portfolio creation from spare change. Its set-it-and-forget-it approach allows anyone to develop investment portfolios. Acorns offers a simple, user-friendly app experience at only $1, $2, or $3 monthly depending on account tier. Unique features like Found Money provide additional portfolio growth opportunities.

Figure 8: Acorns

5. SoFi Automated Investing

SoFi Automated Investing features robust goal planning and portfolio management capabilities. With no account minimums or management fees, the app is designed for convenient, affordable wealth building. SoFi also provides access to financial advisors alongside automation tools for dividend reinvesting, rebalancing, and more. The user interface provides detailed analytics and money management insights.

Figure 9: Sofi Automated Investing

Table 1 provides a detailed feature comparison of the top 5 wealth management applications across critical factors. It enables an objective analysis to determine which platform aligns best with an individual's specific investing needs and financial situation.

Comprehensive comparison of all of the wealth management solutions

Table 1: Comparison of the top 5 wealth management applications

Features | Betterment | Wealth front | Empower | Acorns | SoFi Automated Investing |

Account Minimum | $0 | $500 | $100,000 for advising services | $0 | $0 |

Management Fees | 0.25% - 0.40% | 0.25% | 0.49% - 0.89% for advising services | $1 - $3 per month | 0% |

Investment Approach | Robo-advisor, goal-based | Robo-advisor, tax optimization | Hybrid robo-advisor and human advisors | Robo-advisor, spare change investing | Robo-advisor with human support |

Account Types | IRA, trust, individual, joint | IRA, trust, individual, joint | IRA, trust, individual, joint | IRA, individual | IRA, trust, individual, joint |

Tax Management | Tax-coordinated portfolios | Automated tax-loss harvesting | Tax minimization strategies | Basic tax considerations | Tax minimization strategies |

Customization | Flexible asset allocation adjustments | Limited flexibility | Highly customizable portfolios | Pre-built portfolios only | Flexible asset allocation adjustments |

Financial Planning | Retirement and goal planning | Limited goal planning | Retirement, insurance, and estate planning | Basic goal tracking | Retirement and goal planning |

Security | 256-bit SSL encryption | 256-bit SSL encryption | 256-bit SSL encryption | 256-bit SSL encryption | 256-bit SSL encryption |

Customer Support | Email, phone, chat | Email, phone | Email, phone, chat | Email, phone | Email, phone, chat |

Mobile App | iOS and Android apps | iOS and Android apps | iOS and Android apps | iOS and Android apps | iOS and Android apps |

Conclusion

The top wealth management software platform provides digital access, automated investing, and financial planning capabilities that empower individuals to manage and grow their assets effectively. Today's top-rated fintech apps enable convenience, flexibility, and value. With mobile optimization and intuitive tools, managing finances is easier than ever. The most important factors to evaluate include ease of use, features like automated investing, planning tools, security, costs, and customer support. Selecting apps based on personalized needs and priorities is crucial. For hands-off investors, automated solutions like Betterment and Wealthfront provide robust algorithms to optimize a portfolio. For access to human advisors, Personal Capital and SoFi offer hybrid digital tools and advising services. And for basic, affordable investing, Acorns provides an entry-level solution.

By understanding the critical features of today's leading wealth management apps and objectively comparing options based on individual requirements, wealth firms, wealth management providers, and wealth management vendors can confidently leverage technology to achieve their financial goals. The top apps outlined in this guide represent innovative solutions that can simplify money management, empower smarter investing, and maximize the growth of wealth.

Fintech and Financial Software Development Insights

Are you intrigued by the rapidly evolving world of fintech and financial software development? At Mobile Reality, we take pride in our extensive knowledge and experience in this dynamic field. We navigate complex challenges, implement innovative strategies, and develop groundbreaking solutions in fintech. Our carefully curated selection of articles offers in-depth perspectives on key aspects of fintech and financial software development:

- Top Fintech Conferences That You Cannot Miss in 2025

- Leveraging Blockchain for Fintech: A Look Ahead to 2025

- Top 10 Best Investment Apps for Business in the US

- AML KYC Simplified: Best Practices for Fintech Apps

- Building an MVP for fintech and modern banking

- What is Open API Banking and How Does it Work?

- Fintech Week NYC: Key Trends and Transformations

- Digital Product Design for Fintech Market

- Top Investment Apps in Europe in 2024

- TOP 10 KYC & AML software companies in 2023

- The Future of Financial Services: AI for Fintech

- Explore the Future of Fintech App Development in 2025

Explore these comprehensive resources to deepen your understanding of the fintech sector. If you have any questions or are interested in exploring partnership opportunities in fintech software development, please contact our sales team. For those aspiring to join our innovative team, visit our careers page to submit your CV. Join us in driving the future of fintech and financial software development!