Introduction

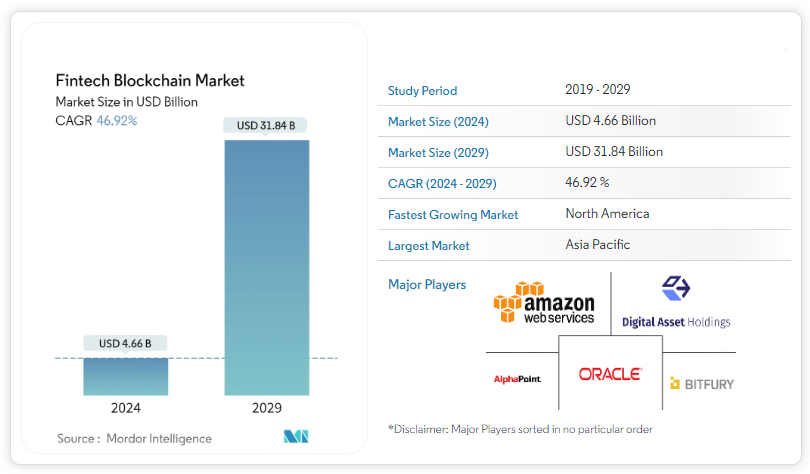

The intersection of blockchain in finance (fintech) is shaping a revolutionary path for the financial industry, signaling a significant shift towards more secure, transparent, and efficient financial services. As we gaze into the industry outlook for 2025, according to Mordor Intelligence , the fintech blockchain market is poised to undergo remarkable growth. Its size is estimated at USD 4.66 billion and is projected to surge to USD 31.84 billion by 2029. This impressive growth trajectory boasts a Compound Annual Growth Rate (CAGR) of 46.92% during the forecast period (2024-2029). It underscores blockchain's vibrant dynamism and potential within the fintech sector.

Figure 1: Blockchain Fintech Statistics | Source: Mordor Intelligence

Several factors contribute to this exponential growth, including the burgeoning market cap of cryptocurrencies and Initial Coin Offerings (ICOs). The escalating demand for distributed ledger technology (DLT) and financial institutions' widespread adoption of advanced blockchain solutions.

The adoption of cryptocurrencies and digital tokens as mediums for transactions promises to further energize the market. Many fintech organizations are now leveraging blockchain technology to streamline business processes, mitigate fraudulent activities, and elevate the quality of customer service. Platforms like Ripple are at the forefront of this adoption, heralding a future of increased acceptance and innovation.

Stablecoins emerge as a notable trend within this landscape, prized for their potential to increase liquidity, reduce costs, and imbue stability. They represent an intriguing facet of Decentralized Finance (DeFi) protocols, poised to catalyze innovation across numerous industries in the coming years. The expected integration of DeFi and blockchain technology is set to foster unprecedented innovation across a broad spectrum of sectors.

However, the journey is not devoid of challenges. The COVID-19 pandemic has cast a shadow over many industries, including the fintech blockchain sector. Lockdowns and supply chain disruptions have introduced uncertainties, complicating predictions for the industry's resurgence. Despite these hurdles, systemic changes induced by the pandemic are likely to leave a lasting imprint on the sector, propelling it towards sustained growth in the years ahead. This vibrant outlook for blockchain in fintech encapsulates a world of opportunities, challenges, and transformative potential, setting the stage for an exciting era of financial innovation and evolution.

Blockchain Benefits for Financial Institutions and Business

Enhanced security and reduced fraud risk

Enhanced security and reduced fraud risk are among the most significant advantages of leveraging blockchain technology in the financial sector. Its decentralized and unchangeable nature ensures blockchain's secure structure for financial transactions.

Unlike traditional centralized systems that rely on a single point of control, blockchain operates as a distributed ledger replicated across multiple nodes in a peer-to-peer network. This decentralization eliminates single points of failure, making it highly resistant to cyber-attacks, data breaches, and system failures. Additionally, every blockchain transaction is securely encrypted for data integrity and authenticity. Once a transaction is verified and added to the ledger technology, it cannot be altered.

Faster and cheaper transactions

Blockchain technology enables faster and more cost-effective financial transactions by eliminating intermediaries and streamlining processes. Traditional systems involve multiple intermediaries like central bank, clearinghouses, and third-party providers, leading to delays and additional costs.

However, blockchain's decentralized and peer-to-peer nature allows direct transactions between parties, cutting out these intermediaries. Transactions can be validated and recorded on the blockchain network rapidly, in minutes or seconds, compared to days or weeks in traditional systems.

Decentralized systems without intermediaries

Blockchain technology enables decentralized financial systems that operate without central authorities or intermediaries. Financial transactions occur directly between peers on the decentralized blockchain network, eliminating the need for intermediaries like banks or clearinghouses.

Removing intermediaries promotes transparency by making transaction data viewable and reducing costs by cutting out intermediary fees and overhead expenses. Decentralized systems built on blockchain technology can operate autonomously without relying on a single point of control or failure, making them more resilient and less susceptible to manipulation.

Improved transparency and audibility

Transactions recorded on the blockchain are transparent and auditable, providing a clear trail of financial activities and promoting accountability in the financial industry. All transactions on a blockchain are recorded publicly in an immutable distributed ledger, offering a virtually tamper-proof audit trail.

Parties can view transaction details such as the amount, timestamp, and associated blockchain addresses, improving transparency and enabling scrutiny. This transparency enhances accountability, as financial data is open for auditors, regulators, and the public to monitor, fostering improved oversight and governance within the financial sector.

Automation through smart contracts

Smart contracts, self-executing contracts built on blockchain technology, can automate various financial processes, reducing the need for manual interventions and increasing efficiency. These programmed agreements execute automatically on the blockchain, with their code defining the rules and penalties around negotiating the terms of a contract. Once deployed, intelligent contracts run as programmed without any third-party interference or exceptions, automating the execution and enforcement of contractual agreements.

By minimizing human involvement and the need for intermediaries, smart contracts streamline financial transactions, increasing efficiency and reducing costs associated with manual processes and intermediaries.

Access for the underbanked through disintermediation

By removing intermediaries and enabling direct peer-to-peer transactions, blockchain technology can provide financial services to underbanked populations, promoting financial inclusion. Blockchain disintermediates finance, allowing individuals to engage in financial transactions without the need for traditional financial institutions.

This disintermediation removes barriers such as high fees and minimum balance requirements, making financial services more accessible and affordable. Underbanked populations can access services like cross-border payments, lending, and microfinance through blockchain-based applications, empowering underserved communities and fostering economic participation on a global scale.

Matt Sadowski

CEO of Mobile Reality

Fintech Software Development Tailored to Your Needs

We specialize in delivering reliable and compliant software solutions for the financial industry, designed to meet your specific requirements.

Comprehensive development for fintech systems and financial services.

Secure and scalable solutions built to industry standards.

Expertise in compliance with financial regulations.

Support for digital banking, payments, and data analytics.

Customized fintech AI agents to streamline your operations.

Innovative Applications of Blockchain in Fintech

1. Payments and money transfers

Payments and money transfers Blockchain technology is transforming the payments and money transfer industry by enabling faster, cheaper, and more secure cross-border transactions through decentralized blockchain payment processing systems. Platforms like Ripple (ripple.com) utilize blockchain to facilitate transactions between different currencies and financial institutions, while Stellar (stellar.org) provides a decentralized protocol for facilitating cross-asset transfers of value globally.

Circle (circle.com) offers a blockchain-based payments infrastructure and stablecoin (USD) for seamless money transfers. These systems eliminate intermediaries, reducing fees and settlement times for international money transfers. Additionally, they provide transparency and immutability, enhancing security and mitigating fraud risks in payment processing.

2. Lending and credit services

Lending and credit services Blockchain technology enables the creation of decentralized lending and borrowing platforms without the need for traditional financial intermediaries. Salt Lending (saltlending.com) allows users to leverage their sense of Bitcoin and cryptocurrency holdings as collateral for cash loans.

At the same time, Celsius Network (celsius. network) provides a decentralized lending platform where users can earn interest on their future crypto assets. These platforms use smart contracts to automate the lending overhead costs and increase accessibility. They offer global access to credit services, promoting financial inclusion for underbanked populations. Furthermore, the transparency and immutability of blockchain records enhance trust and reduce risks of fraud or manipulation in crypto lending and credit services.

3. Investment and wealth management

Investment and wealth management The investment and wealth management industry is being revolutionized by blockchain technology through the emergence of tokenized securities platforms. Polymath (polymath. network) provides a platform for issuing and managing security tokens backed by real-world assets. At the same time, Securitize (securitize.io) offers a complete fintech solution for digitizing traditional securities on the blockchain. These platforms enable fractional ownership and streamlined trading of alternative assets like real estate, art, and private equity.

Smart contracts automate tokenized securities' compliance, dividend distribution, and governance processes. Increased liquidity, transparency, and accessibility make alternative investments more inclusive and accessible to a broader investor base.

4. Insurance

Insurance Companies like Etherisc (etherisc.com) and Insurepal (insurepal.io) are leveraging blockchain technology to create decentralized insurance platforms. Smart contracts automate insurance policies, claim processing, and payouts, reducing manual interventions and costs. Transparent claims handling on the blockchain enhances trust and reduces the risk of fraud or disputes.

Peer-to-peer insurance models enabled by blockchain provide coverage to underserved populations without traditional intermediaries. Parametric insurance products triggered by predefined events can be executed automatically using blockchain-based oracles. Increased accessibility, transparency, and efficiency make insurance services more inclusive and affordable for a broader range of customers.

The insurance industry stands to benefit significantly from the integration of blockchain technology. Fintech companies like Etherisc and Insurepal are pioneering the development of decentralized insurance platforms built on blockchain. These platforms leverage smart contracts to automate insurance policies, claim processing, and payouts, reducing the need for manual interventions and associated costs. The transparent nature of blockchain networks enhances trust in the claims handling triggered by predefined event processes by providing an immutable record of transactions, reducing the risk of fraud or disputes.

5. Identity management

Identity management Blockchain offers secure and decentralized storage of personal information for identity management solutions. Civic (civic.com) provides a blockchain-based platform for securely verifying and managing digital identities, while SelfKey (selfkey.org) enables users to create and manage their digital identities on the blockchain.

These solutions give individuals control over their data, reducing reliance on centralized authorities. Immutable records on the blockchain ensure data integrity and prevent unauthorized modifications to identity information. Decentralized identity solutions promote privacy, security, and user autonomy in managing personal information.

Identity management is a critical aspect of the financial services industry, and blockchain technology offers a secure and decentralized solution for managing personal information and digital identities. Blockchain-based identity platforms like Civic and SelfKey enable individuals to take control of their data, reducing reliance on centralized authorities. These solutions leverage blockchain's immutable and transparent nature to create tamper-proof digital identities stored on a distributed ledger.

6. Compliance and security

Compliance and security Blockchain analytics and compliance platforms like Chainalysis (chainalysis.com) and Elliptic (elliptic. co) help monitor blockchain transactions and provide tools to detect and prevent illicit activities like money laundering, fraud, and terrorism financing. These compliance solutions ensure adherence to regulatory requirements and anti-money laundering (AML) guidelines.

The blockchain's transparent and immutable transaction records enable comprehensive audit trails for regulatory oversight. Additionally, blockchain security solutions leverage cryptographic techniques and consensus mechanisms to secure financial data and transactions. The enhanced transparency, traceability, and security blockchain technology offer strengthened compliance and risk management practices in the financial sector.

Challenges and Limitations of Blockchain for Fintech

While blockchain technology offers numerous benefits and innovative applications in the fintech industry, many blockchain networks face challenges and limitations. One of the most significant hurdles is the scalability issues many blockchain networks face. The decentralized nature of blockchain and its consensus mechanisms can lead to slower transaction processing times as network usage increases. Popular blockchain networks like Bitcoin and Ethereum currently have relatively low throughput, processing only a handful of transactions per second.

This limited scalability can cause network congestion, higher transaction fees, and longer confirmation times, hindering widespread adoption in high-volume fintech applications. Ongoing research and development efforts focus on scaling solutions, such as sharding, layer-2 solutions, and alternative consensus algorithms, to improve blockchain's scalability and enable seamless integration into the fintech strategy and fintech sector.

Scalability issues

Many existing blockchain networks face scalability challenges that limit their ability to handle high transaction volumes efficiently, potentially hindering widespread adoption in the fintech industry. The decentralized nature of blockchain and its consensus mechanisms can lead to slower transaction processing times as network usage increases. Popular blockchain networks like Bitcoin and Ethereum currently have relatively low throughput, processing only a handful of transactions per second.

This limited scalability can cause network congestion, higher transaction fees, and longer confirmation times, making it challenging to meet the high-volume demands of fintech applications. Ongoing research and development efforts focus on scaling solutions, such as layer-2 solutions and alternative consensus algorithms, to improve blockchain's scalability and enable seamless integration into the fintech sector.

Privacy concerns

While blockchain transactions are pseudonymous, concerns exist around the potential deanonymization of users and the privacy implications of publicly accessible transaction data. Although public blockchains provide transparency by making transaction data accessible, this transparency also allows observers to link blockchain addresses to real-world identities through transaction analysis.

Privacy concerns arise from the visibility of transaction patterns and financial activities on these transparent networks. Regulatory bodies may require mechanisms to prevent illegal activities, raising concerns about user privacy and data protection. To address these issues, privacy-enhancing technologies, such as zero-knowledge proofs and confidential transactions, are being explored to balance transparency and privacy while maintaining the integrity of blockchain networks.

Adoption challenges

Despite the potential benefits, adopting blockchain technology in the fintech industry faces several hurdles and challenges.

Resistance to change and skepticism about blockchain's disruptive nature can slow its adoption by traditional financial institutions.

Lack of standardization and interoperability between blockchain platforms and networks can hinder widespread adoption and integration.

Education and awareness about blockchain technology, its capabilities, and its implications still need to be improved among stakeholders and the general public.

Concerns about regulatory uncertainty, security risks, and the complexity of integrating blockchain solutions can impede adoption efforts.

Integration with legacy systems

Integrating blockchain solutions with legacy systems and processes in the fintech industry can be complex and costly. Legacy systems were built on centralized architectures and may not be compatible with the decentralized nature of blockchain technology. Bridging the gap between traditional and blockchain-based systems requires significant resources, expertise, and careful planning.

Data migration, system interoperability, and consistent user experiences across different platforms can pose challenges during integration. Additionally, the costs associated with upgrading or replacing legacy infrastructure can be a barrier, particularly for smaller financial institutions or startups, potentially slowing down the adoption of blockchain in the fintech industry.

Evolution of blockchain technology

As blockchain technology evolves, new developments and advancements, such as scalability solutions, privacy-enhancing techniques, and interoperability protocols, will shape its future applications in fintech.

Hybrid models combining blockchain with other technologies

The emerging hybrid models that combine blockchain with other technologies, such as artificial intelligence (AI) and web3, are gaining traction in the fintech industry. For example, platforms like Endotech (endotech.io) and Avalanche (avax. network) are exploring the integration of AI and blockchain to enhance decision-making, automate processes, and provide personalized financial services.

Hybrid Models Combining Blockchain with AI

The emerging hybrid models combining blockchain with artificial intelligence (AI) are gaining traction in fintech. For example, platforms like Endotech (endotech.io) are exploring the integration of AI and blockchain to enhance decision-making, automate processes, and provide personalized financial services. Combining AI's robust data analysis and decision-making capabilities with blockchain's transparency and immutability can lead to more efficient and intelligent financial solutions.

Hybrid Models Combining Blockchain with Web3

In addition to AI, blockchain is also being integrated with web3 technologies, which encompass decentralized applications (dApps), decentralized finance (DeFi), and decentralized autonomous organizations (DAOs). Platforms like Avalanche (avax. network) are leveraging the synergies between blockchain and web3 to create a decentralized finance world, enabling peer-to-peer financial services, tokenized assets, and decentralized governance models.

Potential Benefits of Hybrid Models

These hybrid models combining blockchain with AI and web3 have the potential to revolutionize the fintech industry. AI can enhance blockchain-based financial services by providing intelligent decision-making, predictive analytics, and personalized recommendations. Web3 technologies can unlock new decentralized business models, enabling disintermediation, increased transparency, and community-driven governance. Together, these technologies can create more efficient, secure, and inclusive financial services that empower users and challenge traditional centralized systems.

Regulatory clarity and standards

As blockchain adoption in fintech continues to grow, regulatory bodies are working to clarify and establish standards to ensure consumer protection and mitigate potential risks. In the European Union, the Markets in Crypto-Assets (MiCA) regulation aims to create a comprehensive regulatory framework for crypto-assets and related services. In the United States, the Securities and Exchange Commission (SEC) has proposed rules for the custody of digital asset securities. At the same time, the Office of the Comptroller of the Currency (OCC) has guided the use of blockchain technology in the banking industry.

Another challenge lies in the potential privacy concerns associated with blockchain technology. While blockchain transactions are pseudonymous, there are concerns about the potential deanonymization of users through transaction analysis. Public blockchains make transaction data accessible, allowing observers to link blockchain addresses to potentially real-world identities. Privacy concerns arise from the transparency of blockchain networks, which can reveal transaction patterns and financial activities.

Regulatory bodies may require mechanisms to prevent illegal activities, raising concerns about user privacy and data protection. To address these issues, privacy-enhancing technologies, such as zero-knowledge proofs and confidential transactions, are being explored to balance transparency and privacy while maintaining the integrity of blockchain fintech solutions.

Web3 Kudos Sofware ToBOOST RETENTION RATE!

Flaree, the employee egamenet platform. SaaS tool for HR departments to boost motivation and recognition in remote and hybrid teams! First HR blockchain-based solutions for hybrid and remote teams.

Conclusion

The fintech industry is poised to experience significant transformations driven by the adoption of blockchain technology in 2025 and beyond. While challenges and limitations exist, blockchain's potential advantages, such as enhanced security, transparency, and efficiency, drive innovation and adoption across various fintech applications. As the technology continues to evolve and regulatory frameworks become more established, integrating blockchain implementation challenges with other emerging technologies like AI and Web3 will further shape the future of the fintech industry.

Blockchain technology is poised to reshape the fintech landscape, offering unparalleled security, transparency, and efficiency in financial services. As the industry embraces this transformative technology, we expect to see further innovations combining the future of blockchain with other cutting-edge technologies like artificial intelligence and web3. Ultimately, the successful integration of blockchain will depend on overcoming remaining challenges, such as scalability issues and regulatory uncertainties, paving the way for a more inclusive, secure, and user-friendly financial ecosystem.

Fintech and Financial Software Development Insights

Are you intrigued by the rapidly evolving world of fintech and financial software development? At Mobile Reality, we take pride in our extensive knowledge and experience in this dynamic field. We navigate complex challenges, implement innovative strategies, and develop groundbreaking solutions in fintech. Our carefully curated selection of articles offers in-depth perspectives on key aspects of fintech and financial software development:

- Top Fintech Conferences That You Cannot Miss in 2025

- Top 5 Wealth Management Solutions in 2025

- Top 10 Best Investment Apps for Business in the US

- AML KYC Simplified: Best Practices for Fintech Apps

- Building an MVP for fintech and modern banking

- What is Open API Banking and How Does it Work?

- Fintech Week NYC: Key Trends and Transformations

- Digital Product Design for Fintech Market

- Top Investment Apps in Europe in 2024

- TOP 10 KYC & AML software companies in 2023

- The Future of Financial Services: AI for Fintech

- Explore the Future of Fintech App Development in 2025

Explore these comprehensive resources to deepen your understanding of the fintech sector. If you have any questions or are interested in exploring partnership opportunities in fintech software development, please contact our sales team. For those aspiring to join our innovative team, visit our careers page to submit your CV. Join us in driving the future of fintech and financial software development!