Introduction

Combating financial crimes and ensuring compliance with KYC and AML regulations pose significant challenges in the ever-changing finance industry. Technology-driven companies like Shufti Pro have emerged as leading providers of cutting-edge KYC and AML software to meet these demands. These innovative solutions empower financial institutions with fraud detection, risk assessment, and identity verification tools, enhancing compliance and security.

Before, we’ve written “Ensuring Financial Safety: A Deep Dive into AML and KYC Practices in Fintech Apps” article in which we’ve told you about the significance of AML and KYC in fintech apps, exploring how these practices contribute to maintaining a secure and trustworthy environment for financial transactions. In this article, we will continue to dive into this topic by highlighting the Top 10 KYC and AML Software Companies.

They offer document verification, transaction monitoring, and customer due diligence solutions, empowering banks and fintech firms to stay ahead in the fight against financial crimes. Join us as we delve into their contributions, forging a path toward a safer and more secure financial world.

KYC & AML software market analysis

Amidst the surging popularity of cryptocurrencies, scammers have found a lucrative haven, exploiting the anonymity of digital assets for illicit activities. Shockingly, in 2022, hackers stole a staggering $4.3 billion worth of cryptocurrency, witnessing a 37% surge compared to the previous year's figures, as reported by Sanction Scanner. Notably, social media platforms facilitated most crypto scams, allowing for stealthy operations.

In response to these challenges, industry participants, banks and fintechs, and finance companies hope implementing stringent legal regulations in 2023, including the Bank Secrecy Act and customer due diligence, could restore faith in the sector. Key players like the United States and the European Union have committed to crafting a robust regulatory framework for cryptocurrencies this year.

With the crypto money markets experiencing a rollercoaster ride, the need for solutions in KYC processes, regulatory compliance, and AML checks becomes paramount. Players from the anti-money laundering software sector, reliable KYC software tools, are instrumental in combating suspicious activities and preventing terrorist financing through comprehensive financial transaction monitoring, analysis, and customer and transaction screening.

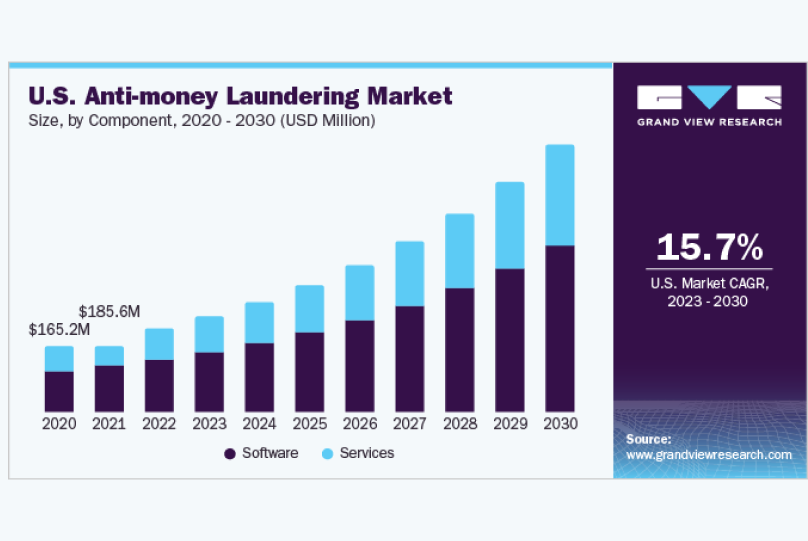

Figure 1: AML statistics | Source: GVS

Also, Grand View Search reports that in 2022, the global anti-money laundering market showcased remarkable growth, attaining a significant value of USD 1.32 billion. Looking ahead, this market is projected to witness a compelling compound annual growth rate (CAGR) of 15.9% from 2023 to 2030. The driving force behind this surge in the AML market is the escalating adoption of digital payments worldwide.

The recent collapse of FTX has heightened discussions on the future of the crypto industry and the next steps regulators will take. Against this backdrop, it's clear that enhancing crypto regulations, including AML compliance, will be a top priority in the fight against financial crimes, focusing on AML trends for 2023. As the industry faces this critical phase, implementing tighter AML controls, along with solutions like KYC software presented in our ranking, becomes crucial to safeguard investors and bolster the credibility of cryptocurrencies in the global financial landscape. Document verification, financial crime prevention, and compliance with sanction scanner technologies are paramount for financial institutions to navigate this period effectively.

Selection Criteria for the TOP 10 KYC & AML Software Companies

To curate our list of the top 10 KYC and AML software companies in 2023, we carefully considered the following criteria:

Industry knowledge

The selected companies operate within the AML KYC software technology market. They have a profound understanding of emerging technologies like artificial intelligence, blockchain, IoT, virtual reality, and machine learning, we possess the capability to handpick the best of the best among fast-growing KYC & AML companies. Their unique insights and capabilities enable them to offer cutting-edge solutions and stay at the forefront of the rapidly evolving KYC & AML solutions market.

Fast-growing and Scalable

The selected companies have demonstrated an impressive track record of rapid growth, showcasing their agility in adapting to market demands, scaling their operations, and driving substantial revenue. Their innovative approaches, robust business models, and successful execution strategies position them as trailblazers in the fast-paced KYC & AML landscape.

High rating

The chosen companies boast an exceptional track record, reflected in their remarkable ratings of 4.5 and above on prominent platforms like G2 or Capterra. These high ratings testify to their unparalleled AML KYC software industry expertise. Customers and users have consistently praised their services and solutions, endorsing the companies as leaders in the field.

Expertise and experience

Our selection process involved leveraging our experience and knowledge in the financial software market. We considered companies that showcased unique and innovative approaches to solving industry challenges, distinguishing them from their competitors.

By meeting these stringent criteria, these app companies solidify their positions as industry leaders and drivers of growth in the dynamic market as the best AML software solutions and KYC software solutions and tools for 2023.

Unique List of The Best AML KYC Software 2023

Company | Reviews | Headcount | HQ |

|---|---|---|---|

Shufti Pro | 72 employees | London, the UK | |

SEON. Fraud Fighters | 246 employees | Budapest, Hungary | |

iDenfy | 40 employees | Kauno, Lithuania | |

Ondato | 140 employees | London, England, United Kingdom | |

ComplyCube | 16 employees | London, England, United Kingdom | |

Unit21 | 124 employees | San Francisco, California, United States | |

Fugu | 14 employees | Tel Aviv-Yafo, Israel | |

Know Your Customer | 54 employees | Wan Chai, Hong Kong SAR | |

Pliance | 10 employees | Stockholm, Sweden | |

Quantifind | 76 employees | Palo Alto, California, United States |

Are you looking for software provider to integrate your system with KYC and AML software?

Shufti Pro - KYC & Anti Money Laundering Software

Shufti Pro is a leader in Identity Verification, blending Artificial Intelligence (AI) and Human Intelligence (HI) to offer secure and flexible solutions for identity verification and KYC/AML compliance. It provides a broad range of services including KYC/AML/KYB screening, biometric authentication, continuous monitoring, age verification, Video KYC, and touchless airport security kiosks. Widely used across industries like e-commerce, finance, fintech, education, and healthcare, Shufti Pro is recognized for enhancing fraud prevention, customer onboarding, and risk mitigation while simplifying KYC/AML compliance.

Shufti Pro utilizes advanced technologies such as biometric facial recognition and sophisticated anti-spoofing techniques to deliver a secure and efficient business verification process. This enables clients to focus on expansion and scalability with a strong security protocol in place. Committed to data protection, Shufti Pro adheres to GDPR, PCI DSS, and cyber essentials, ensuring high security standards and data safety for clients and their customers.

Overall, Shufti Pro stands as a technological ally in secure and efficient identity verification, supporting businesses across various sectors with its innovative AI and HI technologies and robust security measures.

SEON Fraud Fighters

SEON, known as "Fraud Fighters," is a leading fraud prevention SaaS company that equips businesses with tools to protect against online fraud and cyber threats. SEON offers seamless integration with its modular APIs, enabling businesses to analyze customer data and create a multi-layered fraud detection strategy through top features like device fingerprinting. Its machine-learning algorithm provides transparent, data-driven recommendations, while digital footprint analysis across over 50 social networks helps identify potential fraud. By allowing businesses to combat cyber threats effectively without the high costs of traditional ID verification, SEON enhances online security for businesses and their customers.

iDenfy

iDenfy is a leading identity verification and fraud prevention platform, designed to enhance KYC/KYB/AML compliance with minimal effort. It leverages Artificial Intelligence, innovative selfie biometrics, and an expert in-house team to achieve high accuracy and simplify user onboarding. The platform offers customizable compliance solutions that integrate smoothly with minimal coding, balancing user convenience with security. It supports over 2,000 applications, including major platforms like WordPress, Shopify, and Slack, facilitating broad integration.

Recognized in G2’s Winter 2023 report as a top identity verification platform, iDenfy is trusted by over 500 organizations worldwide, including the Bank of Lithuania and Juni. The platform provides a comprehensive approach to security and compliance, making it a robust, user-friendly solution for businesses looking to protect their digital interfaces and enhance user verification processes.

iDenfy positions itself as a strategic ally in digital verification, continuously innovating to offer secure, efficient, and seamless identity verification solutions across the digital landscape.

Ondato

Ondato is a leading technological firm that integrates KYC and AML processes to enhance compliance and business utility. The company excels in digital identity verification, customer onboarding, data validation, and fraud detection, setting high standards for both online and offline onboarding processes. Ondato offers a comprehensive suite that includes business onboarding, a customer data platform, due diligence procedures, and authentication solutions, all designed to integrate seamlessly into daily operations and cover all stages of customer lifecycle management.

Ondato positions itself as a crucial ally in identity management and compliance, providing a platform that ensures regulatory adherence and improves data management and customer interaction. The platform spans the entire customer management journey, ensuring secure, compliant, and beneficial interactions from initial onboarding to continuous oversight.

In summary, Ondato combines technology and compliance to meet the complex needs of businesses managing customer data, regulatory compliance, and fraud prevention. With a focus on evolving with technological and regulatory changes, Ondato stands as a reliable and efficient partner for businesses navigating the intricate landscape of digital identity verification and compliance management.

ComplyCube

ComplyCube is a comprehensive platform designed to automate and streamline Identity Verification (IDV), Anti-Money Laundering (AML), and Know Your Customer (KYC) processes, catering to various sectors like legal, telecoms, financial services, healthcare, e-commerce, cryptocurrency, and travel. The platform offers a complete, flexible, and cost-effective range of AML/KYC features, suitable for businesses from startups to multinational enterprises, helping them maintain a secure operating environment.

ComplyCube stands out for its rapid omnichannel integration, providing numerous integration options such as Low/No-Code solutions, KYC & AML API integrations, mobile and web SDKs, Client Libraries, and CRM Integrations, which allow for easy implementation and adaptability.

The platform transcends traditional compliance solutions by offering a flexible framework tailored to the specific needs of diverse sectors. It is committed to continuous evolution to keep pace with changing technology and regulatory standards, ensuring it remains effective against future challenges in the digital and regulatory landscapes.

In essence, ComplyCube combines advanced technology with adaptive solutions to help businesses manage IDV, AML, and KYC compliance efficiently, allowing them to focus on core business activities while maintaining secure and trustworthy operations.

Unit21

Unit21 emerges as a prominent platform empowering businesses across diverse industries with cutting-edge tools to combat adversaries and detect complex risks like money laundering and fraud. Through its user-friendly API and intuitive dashboard, Unit21 equips businesses with proactive capabilities to manage and mitigate potential threats effectively.

As a leader in its field, Unit21 offers a comprehensive suite of advanced solutions that enable businesses to stay ahead of emerging risks and safeguard their operations. With a focus on simplicity and ease of use, Unit21 streamlines the risk management process, empowering businesses to respond swiftly and effectively to potential threats.

With Unit21's powerful capabilities and features at their disposal, businesses can enhance their risk detection and prevention strategies, ensuring compliance with regulatory requirements and protecting their customers and assets. By leveraging Unit21's advanced tools, companies can confidently navigate the ever-changing landscape of risk management and stay one step ahead of adversaries.

FUGU

FUGU is a leading provider of payment fraud detection software, serving businesses of all sizes and industries globally. With a team of dedicated experts and a mission to make online transactions safer and more seamless, FUGU has garnered a reputation for its innovative approach to fraud prevention. FUGU's post-checkout verification system sets it apart from traditional fraud prevention measures, allowing merchants to confidently accept transactions while minimizing the risk of false declines.

By leveraging advanced technology and data-driven insights, FUGU enables businesses to stay one step ahead of fraudsters and safeguard their bottom line. Trusted by hundreds of merchants worldwide, FUGU has proven to be a game-changer in the battle against payment fraud and customer churn. Its commitment to providing a secure and frictionless payment experience has earned it a loyal customer base and industry recognition as a frontrunner in the payment fraud solutions landscape.

Whether it's protecting against fraudulent transactions, reducing false declines, or ensuring a seamless checkout process, FUGU is dedicated to empowering businesses to thrive in the dynamic world of online payments, leaving them with the peace of mind to focus on their core operations and growth.

Know Your Customer

Know Your Customer (KYC) is a renowned regulatory technology (RegTech) company that stands tall as a pioneering force in the financial industry. With a focus on cutting-edge digital onboarding, anti-money laundering, and KYC/KYB (Know Your Business) solutions, they play a pivotal role in providing essential support to financial institutions and regulated organizations across the globe.

With KYC's expertise and innovative solutions, financial institutions can streamline customer onboarding processes and effectively mitigate risks associated with money laundering and other financial crimes. Their state-of-the-art technology empowers businesses to adhere to stringent regulatory requirements, ensuring compliance and fostering trust within the financial ecosystem.

Recognized for their unwavering commitment to excellence and data-driven insights, KYC remains at the forefront of the industry, shaping the future of regulatory technology. As a trusted partner to financial organizations, KYC enables seamless operations, heightened security, and strengthened compliance measures, ultimately contributing to a more resilient and secure economic landscape.

Pliance

Pliance stands as a cutting-edge API-first service committed to empowering modern, technology-driven companies by automating their Anti-Money Laundering processes. With their API-driven solutions, Pliance enables businesses to seamlessly streamline workflows, optimize efficiency, and dedicate more time to delivering exceptional value to their customers.

As a dedicated partner, Pliance harnesses the power of technology to revolutionize Anti-Money Laundering processes, ensuring compliance with regulations while simplifying the complexities associated with AML requirements. Businesses can focus on their core objectives, drive growth, and enhance customer experiences by automating these critical processes. With Pliance's state-of-the-art API-driven service, companies can proactively detect and prevent financial crimes, mitigating risks and safeguarding their reputation. The seamless integration of Pliance's solutions allows businesses to optimize their operations and stay ahead in the ever-evolving landscape of AML compliance.

Through its innovative approach and commitment to efficiency, Pliance empowers businesses to excel in their industries while maintaining the highest standards of regulatory compliance. Embrace Pliance's forward-thinking solutions and drive your company towards a safer, more secure, and prosperous future.

Quantifind

Quantifind is an exceptional data science technology company that has redefined the landscape of risk detection and fraud detection software . With their powerful AI platform, Quantifind has forged strategic partnerships with some of the world's largest banks, delivering unparalleled solutions to effectively combat money laundering and fraud.

The team at Quantifind possesses a relentless drive for innovation, and their AI-powered solutions demonstrate their commitment to empowering financial institutions with cutting-edge tools. Their expertise in understanding the intricacies of the ever-evolving threat landscape has earned them a reputation as leaders in the industry. With a blend of domain knowledge and advanced technology, Quantifind's tailored solutions are perfectly suited to address the unique challenges faced by financial institutions today. They have proven to be instrumental in identifying patterns, anomalies, and suspicious activities, enabling their partners to stay proactive in mitigating risks. The company's unwavering dedication to pushing the boundaries of data science and technology is evident in their quest to create a safer and more secure financial landscape.

As a partner, Quantifind empowers businesses to confidently navigate the complexities of risk detection and fraud prevention, safeguarding their reputation and the interests of their clients. With Quantifind by their side, financial institutions can thrive in an increasingly digitized world, armed with innovative solutions that stay ahead of financial criminals.

Conclusion

In the pursuit of combating financial crimes and ensuring regulatory compliance, the finance industry has placed paramount importance on Know Your Customer (KYC) and Anti-Money Laundering (AML) practices. Technology-driven companies have emerged as transformative forces, revolutionizing KYC and AML procedures.

Throughout this article, we explored the best AML software solutions and KYC tools, witnessing their unwavering commitment to reshaping financial security. These companies have led the fight against fraud, streamlining due diligence processes with cutting-edge identity verification services and intelligent risk assessment tools.

As the demand for comprehensive and efficient solutions rises, these companies stand as beacons of progress, forging a path towards a safer and more secure financial world. With their dedication to leveraging technological advancements, they have redefined the approach to financial security, inspiring confidence and trust in the industry. Their solutions encompass KYC procedures, fraud prevention, customer identity verification, and adherence to regulatory requirements, combating identity theft and suspicious transactions.

Fintech and Financial Software Development Insights

Are you intrigued by the rapidly evolving world of fintech and financial software development? At Mobile Reality, we take pride in our extensive knowledge and experience in this dynamic field. We navigate complex challenges, implement innovative strategies, and develop groundbreaking solutions in fintech. Our carefully curated selection of articles offers in-depth perspectives on key aspects of fintech and financial software development:

- Top Fintech Conferences That You Cannot Miss in 2025

- Leveraging Blockchain for Fintech: A Look Ahead to 2025

- Top 5 Wealth Management Solutions in 2025

- Top 10 Best Investment Apps for Business in the US

- AML KYC Simplified: Best Practices for Fintech Apps

- Building an MVP for fintech and modern banking

- What is Open API Banking and How Does it Work?

- Fintech Week NYC: Key Trends and Transformations

- Digital Product Design for Fintech Market

- Top Investment Apps in Europe in 2024

- The Future of Financial Services: AI for Fintech

- Explore the Future of Fintech App Development in 2025

Explore these comprehensive resources to deepen your understanding of the fintech sector. If you have any questions or are interested in exploring partnership opportunities in fintech software development, please contact our sales team. For those aspiring to join our innovative team, visit our careers page to submit your CV. Join us in driving the future of fintech and financial software development!