Introduction

The fintech, financial technology industry is experiencing an unprecedented boom, reshaping the way we interact with money and revolutionizing traditional financial systems. At the heart of this transformation lies the European Union (EU), home to a vibrant ecosystem of innovative fintech companies driving immense growth and disrupting established norms. As we dive into the year 2023, we find ourselves at the cusp of a new era where fintech enterprises are flourishing and pushing boundaries like never before.

In this article, we take you on a journey to discover the most exciting and fast-growing fintech companies in the EU in 2023. These trailblazers have harnessed cutting-edge technology, leveraged open banking initiatives, and capitalized on shifting consumer behaviors to create groundbreaking solutions that are reshaping the financial landscape.

From digital payments and lending platforms to cryptocurrency exchanges and wealth management tools, these companies are at the forefront of innovation, driving economic progress and transforming the way we manage our finances.

Our comprehensive list showcases the diversity and dynamism within the EU fintech sector, with each company making significant strides in their respective domains. We explore their unique value propositions, disruptive technologies, and the impact they have on traditional financial services. Moreover, we delve into the factors that have fueled their rapid growth, such as regulatory support, strategic partnerships, and the embrace of artificial intelligence and blockchain.

As we navigate through the rankings, you will witness how these companies have not only transformed financial services but have also gained the trust of consumers and investors alike. Their success stories serve as beacons of inspiration for aspiring entrepreneurs and highlight the EU's position as a hotbed of fintech innovation and entrepreneurship.

Join us as we shed light on the 10 Fast-Growing Top Fintech Companies in the EU in 2023. Discover the disruptors, the visionaries, and the game-changers that are shaping the future of finance and steering us toward a more inclusive, efficient, and technology-driven financial ecosystem.

Top 10 fast-growing fintech companies in the EU explained

The fintech sector, which has been the dominant force in European venture capital funding since 2018, is now facing a significant challenge. Figures from the first quarter of 2023 indicate a steep decline in funding, signaling a loss of its top spot among tech sectors.

Sifted states that European fintech companies raised a mere $2 billion in Q1 2023, marking an 83% drop compared to the previous year's $9.7 billion. This decline surpasses even deeptech ($2.9 billion) and climate tech ($2.6 billion) startups, making fintech the hardest-hit sector in the tech industry. Furthermore, the number of funding rounds during this period, totaling 212, is the lowest since Q4 2015, a notable departure from the norm of 300-plus rounds.

Prominent players like Klarna and Checkout.com have experienced significant decreases in their valuations, while the progression of "soonicorns" into unicorns has slowed considerably.

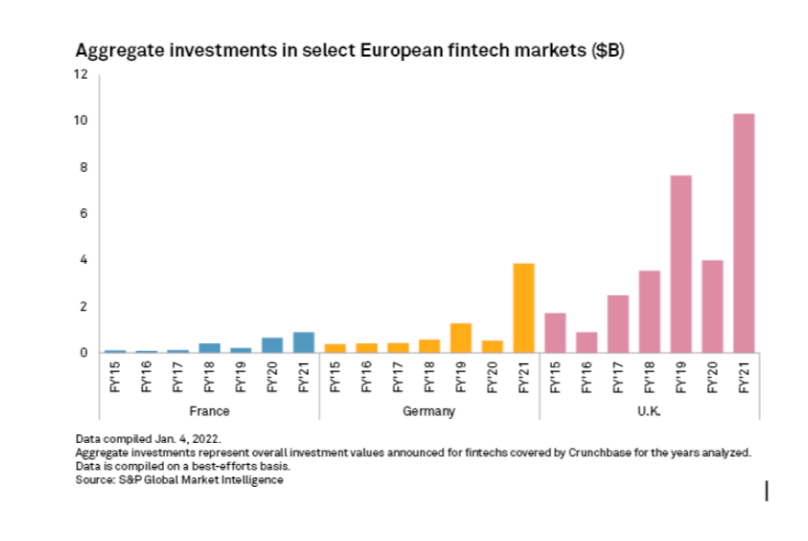

Also, S&P Global reports that investment in the fintech sector across the three countries experienced a significant surge in 2021, reaching over $15 billion. This marks a substantial increase from the previous year's figure of just over $5 billion, which had seen a nearly 50% decline. The United Kingdom, housing Europe's largest fintech hub in London, played a leading role in driving the continent's investment momentum by raising more than $10 billion. This impressive amount surpassed the pre-pandemic total of $7.65 billion recorded in 2019.

In this shifting landscape, investors may be wondering where to focus their attention. Mortgage and lending fintech comapnies, and fintech startups emerged as the primary recipients of funding in the sector, securing $635 million in the first quarter. This surpasses the traditionally dominant areas of payments and banking. Financial management solutions, encompassing treasury management tools such as Norway's Two, raised a total of $382 million. These segments offer comparatively safer investment opportunities for now as the industry awaits the emergence of the next groundbreaking development in fintech, whether that involves meaningful applications of cryptocurrencies, blockchain technology, or another transformative innovation.

Selection criteria for the 10 fast-growing top fintech companies in the EU

In our quest to identify the most promising top fintech companies, and fintech startups in the European Union (EU) for the year 2023, we have meticulously examined a range of criteria to curate a list that showcases the industry's finest. These stringent selection criteria encompass various factors that highlight the companies' growth, influence, and potential.

First and foremost, we have taken into account the headcount of each company, focusing on those with a team size ranging from 51 to 200 employees. This criterion ensures that we highlight not only fledgling startups but also established players that have successfully scaled their operations.

Furthermore, to assess the companies' recent growth trajectory, we have examined their headcount growth over the past 12 months, from June'22 to the end of June'23. Only those demonstrating a remarkable expansion of 30% or more have made it to our coveted list. This criterion ensures that we shine a spotlight on companies that are not only thriving but also driving economic growth and employment opportunities in the EU.

The headquarters location serves as an essential factor, as we have exclusively considered companies based in EU countries. By focusing on these companies, we aim to celebrate the innovation and entrepreneurial spirit that thrives within the EU's financial services sector.

Industry specialization is another key criterion that we have emphasized. The companies selected for our list are exclusively engaged in the financial services sector, reflecting their dedication to transforming and disrupting traditional banking, insurance, investment, and payment systems.

Social media presence also plays a crucial role in our evaluation process. We have identified companies that boast a strong online following, with a minimum of 1,000 followers on their social media platforms. This criterion underscores the companies' ability to engage and connect with a broad audience, showcasing their market reach and influence.

Lastly, we have considered the headcount of each company's IT department. A minimum of 10 IT specialists signifies the companies' technological prowess and their capacity to innovate within the fintech landscape.

By meeting these stringent selection criteria, the 10 fast-growing top fintech companies in the EU demonstrate their ability to solidify their positions as industry leaders. These companies are not only reshaping the financial landscape but also contributing to the overall growth and development of the EU's digital economy. As we celebrate their achievements, we anticipate witnessing their continued success and impact in the dynamic and ever-evolving fintech sector.

Matt Sadowski

CEO of Mobile Reality

Fintech Software Development Tailored to Your Needs

We specialize in delivering reliable and compliant software solutions for the financial industry, designed to meet your specific requirements.

Comprehensive development for fintech systems and financial services.

Secure and scalable solutions built to industry standards.

Expertise in compliance with financial regulations.

Support for digital banking, payments, and data analytics.

Customized fintech AI agents to streamline your operations.

The unique list of top-performing fintech in the EU

1. Keyrock

HQ: Belgium

Growth: 87% growth in the last 12 months

Headcount: The company has a workforce of 124 employees

Keyrock established in Belgium in 2017, is a cryptocurrency market maker focused on developing scalable, self-adaptive algorithmic technologies that enhance the efficiency of digital asset markets.

Keyrock stands out by leveraging in-house algorithmic trading tools, high-frequency trading infrastructure, and deep industry knowledge to deliver exceptional liquidity services. Their expertise extends to serving tokens, exchanges, and brokerages within the cryptocurrency ecosystem.

The fintech company's mission revolves around democratizing cryptocurrency liquidity. They achieve this by adhering to principles of transparency, operational integrity, and regulatory compliance. Keyrock's commitment to these values sets them apart in the industry.

To learn more about Keyrock and explore their cryptocurrency liquidity solutions, you can visit their website at keyrock.eu. There, you can find further information about their offerings, gain insights into their operations, and potentially engage with Keyrock for your cryptocurrency market needs.

2. OKTO

HQ: Greece, Athens

Growth: 64% growth in the last 12 months

Headcount: The company has a workforce of 110 employees

In the fast-paced world of digital payments, OKTO has emerged as a key player, top fintech company empowering every entertainment, leisure, and gaming environment with its cutting-edge technology. This unified payment platform seamlessly merges secure real-world transactions with powerful payment solutions, offering an immersive payment experience for both merchants and users alike. Since its inception in 2019, OKTO has been dedicated to enhancing payment interactions in the online and retail gaming sectors. Leveraging its extensive local knowledge, sector expertise, and global capabilities, OKTO has pioneered frictionless digital payments. Additionally, the company has successfully navigated various regulatory landscapes by adopting an embedded omnichannel approach, ensuring seamless support for customers. With a team of over 100 professionals, including payment experts, gaming insiders, and software engineers, OKTO continues to expand its operations. The company has gained significant traction in some of the most dynamic international markets, including Brazil, Romania, Italy, Greece, Germany, the UK, and Spain. By enabling responsible real-time transactions, OKTO tackles the challenges and risks associated with traditional payment methods head-on. Through its innovative solutions, the company not only removes friction but also opens up new digital transformation opportunities for its customers and millions of consumers worldwide. OKTO's commitment to revolutionizing digital payments is transforming the way transactions are conducted, paving the way for a seamless and secure payment landscape in the future.

3. Blank

HQ: France, Paris

Growth: 48% growth in the last 12 months

Headcount: The company has a workforce of 104 employees

Blank, a pioneering professional neobank, the top fintech company that has been specifically developed to cater to the needs of self-employed individuals. With its intelligent accounting management tool, this innovative platform aims to simplify the lives of self-employed workers, empowering them to focus on their businesses.

No matter your profession—be it a consultant, cabinetmaker, web designer, or plumber—if you have taken the courageous step to establish your own business and operate independently, Blank is here to support you. The self-employed life demands meticulous organization, from the initial setup of your company to its day-to-day management.

Blank becomes your trusted partner, providing invaluable assistance in financial management. By offering a comprehensive view of your profits, striking a balance between provisions and actual income, our tool acts as a steadfast ally in your daily operations. From helping you navigate the selection of the most suitable legal status for your business to seamlessly managing quotes and invoices, Blank guides you every step of the way, simplifying your life.

At Blank, our mission is crystal clear: to save you time, allowing you to devote your energy to what truly matters—your business. We understand that choosing the path of freedom through self-employment is a bold and daring endeavor. That's why we are committed to helping you thrive. Our innovative solutions are designed to remove the complexities of financial management, enabling you to focus on growing your business and achieving success.

4. Upvest

HQ: Germany, Berlin

Growth: 47% growth in the last 12 months

Headcount: The company has a workforce of 139 employees

Upvest is a groundbreaking company on a mission to democratize investing and make it accessible to a wider audience. With their innovative Investment API and digital infrastructure, Upvest empowers businesses to create seamless and secure investment experiences for their end users, transcending international borders.

The core focus of Upvest is to simplify the investment process, enabling businesses to offer exceptional investment opportunities while they concentrate on their core operations. By providing a single Investment API and comprehensive digital infrastructure, Upvest streamlines the entire investment journey, eliminating complexities and allowing businesses to focus on delivering outstanding investment experiences to their customers.

At Upvest, their vision is to make investing as easy as spending money. They believe that investing should not be limited to a privileged few and aim to expand accessibility for hundreds of millions of people. With their Investment API, businesses can now provide investment opportunities that allow individuals to create wealth and make meaningful choices with their money, contributing to a better future.

The team at Upvest, a fintech startup, is passionate about their mission and invites others to join them on this exciting journey. They recognize the significance and enjoyment that comes with democratizing investing and are committed to empowering businesses and individuals alike to participate in the world of investments.

With Upvest, businesses can revolutionize the way they offer investment opportunities, while individuals can unlock the potential to grow their wealth and contribute to causes they believe in. By leveraging the power of their Investment API and digital infrastructure, Upvest is transforming the investment landscape, making it more accessible, exciting, and inclusive for all.

5. Modular Finance

HQ: Sweden, Stockholm

Growth: 42% growth in the last 12 months

Headcount: The company has a workforce of 54 employees

Modular Finance is a cutting-edge financial technology, fintech company that specializes in providing innovative software solutions for the financial industry. With a focus on modular and scalable platforms, Modular Finance empowers financial institutions and professionals to streamline their operations, enhance data analysis capabilities, and make informed investment decisions.

At Modular Finance, their mission is to revolutionize the way financial data is accessed, analyzed, and utilized. They offer a suite of advanced software solutions that enable users to efficiently gather, process, and visualize complex financial data, empowering them to gain actionable insights and make data-driven decisions.

One of the key strengths of Modular Finance is its expertise in modular technology. Their flexible and scalable platforms allow users to customize and integrate various modules according to their specific needs, ensuring a tailored and efficient solution for each client. This modular approach enables financial institutions to optimize their workflows, improve efficiency, and adapt to changing market demands with ease.

6. WALLETTO

HQ: Lithuania, Vilnius

Growth: 32% growth in the last 12 months

Headcount: The company has a workforce of 65 employees

Walletto is an innovative financial technology, top fintech company in the EU that specializes in providing digital wallet solutions and payment services. With a focus on convenience, security, and seamless transactions, Walletto empowers individuals and businesses to manage their finances and make payments efficiently in the digital era.

At Walletto, their mission is to simplify financial transactions and enhance the overall payment experience. This fintech startup offer a range of digital wallet solutions that enable users to securely store payment information, make mobile payments, and manage their funds with ease. Whether it's in-store purchases, online transactions, or peer-to-peer transfers, Walletto provides a convenient and user-friendly platform for seamless financial interactions.

One of the key strengths of Walletto is their commitment to security and data protection. They employ robust encryption technologies and advanced security measures to safeguard user information and transaction data. With their stringent security protocols, Walletto instills trust and confidence in their users, ensuring that their financial transactions are safe and secure.

7. Inpay

HQ: Denmark, Copenhagen

Growth: 31% growth in the last 12 months

Headcount: The company has a workforce of 171 employees

Inpay is a leading global payments company, top fintech company, that specializes in providing innovative and efficient cross-border payment solutions. With a focus on simplifying international transactions, Inpay enables businesses and individuals to send and receive payments securely and swiftly, eliminating the complexities and challenges associated with cross-border transfers.

At Inpay, their mission is to revolutionize the way global payments are made by offering a seamless and cost-effective alternative to traditional banking channels. They leverage a robust network of banking partners and cutting-edge technology to facilitate secure and real-time transfers, ensuring that funds are delivered quickly and efficiently to recipients around the world.

One of the key strengths of Inpay is their deep understanding of the intricacies of international payments. They navigate the complexities of different currencies, regulatory frameworks, and banking systems, providing a reliable and compliant payment infrastructure for businesses operating in diverse global markets. Inpay's expertise and extensive network of banking partners enable them to offer competitive exchange rates and low transaction fees, delivering value and cost savings to their customers.

8. BLIK

HQ: Poland, Warsaw

Growth: 30% growth in the last 12 months

Headcount: The company has a workforce of 90 employees

Blik Payments is a dynamic financial technology, top fintech company in Poland that specializes in providing innovative mobile payment solutions. With a focus on convenience, security, and seamless transactions, Blik Payments empowers individuals and businesses to make payments effortlessly using their mobile devices.

At Blik Payments, their mission is to simplify the payment process and enhance the overall payment experience. They offer a range of mobile payment solutions that allow users to make quick and secure transactions through their smartphones. Whether it's in-store purchases, online payments, or peer-to-peer transfers, Blik Payments provides a user-friendly and efficient platform for seamless financial interactions.

One of the key strengths of Blik Payments is their commitment to security and data protection. They employ advanced encryption technologies and stringent security measures to ensure the privacy and integrity of user information and transaction data. With their robust security protocols, Blik Payments instills trust and confidence in their users, providing a secure environment for their financial transactions.

9. VIALET

HQ: Latvia, Riga

Growth: 30% growth in the last 12 months

Headcount: The company has a workforce of 72 employees

Vialet is an innovative top fintech company that provides a range of digital financial services to individuals and businesses. With a focus on convenience, transparency, and financial empowerment, Vialet offers a comprehensive platform that enables users to manage their finances, make payments, and access essential banking services with ease.

At Vialet, their mission is to revolutionize the way people engage with their finances by offering a user-friendly and inclusive digital banking experience. They provide a range of services that include multi-currency accounts, international money transfers, contactless payments, and prepaid debit cards, all accessible through their intuitive mobile app.

One of the key strengths of Vialet is their commitment to financial transparency and empowerment. They strive to make financial services accessible to all, including those traditionally underserved by traditional banks. Vialet's digital platform offers transparent fees, real-time transaction tracking, and personalized budgeting tools, empowering users to gain better control over their financial lives.

10. Froda

HQ: Sweden, Stockholm

Growth: 30% growth in the last 12 months

Headcount: The company has a workforce of 87 employees

Froda is a Swedish top fintech company that is revolutionizing the banking experience for entrepreneurs, specifically small businesses. Their mission is to help these businesses make a significant impact by offering loans with market-leading terms, quickly and conveniently.

Recognizing the challenges faced by small businesses in accessing affordable financing, Froda was founded with the idea of providing a better solution. Through digitization and streamlining the banking experience, they have eliminated heavy administration, long waiting times, and incorrect assessments by traditional banks. Instead, Froda offers convenient and affordable financing options, tailored to the needs of each business.

Froda's goal is to provide small businesses with the same opportunities for growth as larger companies. They have developed their service to ensure entrepreneurs and small business owners can easily invest in their companies, with the best possible terms. By offering competitive rates and tailored solutions, Froda aims to empower businesses and support their success.

Unlike many traditional lenders, Froda operates with a business model built on shared incentives. They align their interests with their customers' and do not charge reminder fees or hidden costs. This approach fosters a long-term collaboration where both Froda and their customers benefit from the success of the businesses they support. This shared success allows Froda to drive real change, fostering more successful companies, creating jobs, and solving important problems in the world.

Founded in 2015, Froda has already assisted over 50,000 business owners in investing in their ideas. As a regulated credit institution with a government deposit guarantee and under the supervision of the Swedish Financial Supervisory Authority, Froda operates with trust and transparency. They have secured backing from notable investors and industry talents, including individuals from Avanza, Spotify, Google, and Klarna. Nicklas Storåkers, the former CEO of Avanza, serves as Froda's chairman of the board.

Froda's commitment to supporting small businesses and fostering growth positions them as a trusted partner for entrepreneurs in Sweden and beyond.

Conclusion

The fintech industry in the European Union is experiencing an unprecedented boom, with innovative companies reshaping traditional financial systems and transforming the way we interact with money. In this article, we explored the most exciting and fast-growing fintech companies in the EU in 2023, showcasing their groundbreaking solutions and the impact they have on the financial landscape.

Throughout the rankings, we witnessed how these companies have not only transformed financial services but also gained the trust of consumers and investors. Their success stories serve as inspiration for aspiring entrepreneurs and demonstrate the EU's position as a hub of fintech innovation and entrepreneurship.

As we move forward, these fast-growing fintech companies continue to shape the future of finance, driving us toward a more inclusive, efficient, and technology-driven financial ecosystem. They are the disruptors, visionaries, and game-changers that are revolutionizing the industry and propelling us into a new era of financial innovation.

Insights on Leading Fintech Companies

Are you fascinated by the growth and impact of leading fintech companies? At Mobile Reality, we delve deep into the success stories and strategies of top players in the fintech industry. Our expertise in analyzing market trends and company innovations allows us to provide valuable insights into the factors driving the success of these companies. Our curated selection of reports offers a comprehensive look at key fintech companies, their technologies, and market strategies:

- Top 10 Fast-Growing Fintech Companies in the US in 2025

- Top 10 Fast-Growing Fintech Companies in the EU in 2025

- Top 10 Fast-Growing Fintech Companies in the UK in 2025

- Top 10 Fast-Growing Fintech Companies in the EU in 2024

- Top 10 Fast-Growing Fintech Companies in the US in 2024

- Top 10 Fast-Growing Fintech Companies in the UK in 2024

- Top Fintech Companies in New York in 2024

- Top InsurTech Companies in the UK in 2024

- Top Fintech Software Development Companies

- 10 fast-growing top fintech companies in the US in 2023

- 10 fast-growing top fintech companies in the UK in 2023

Explore these detailed reports to gain a deeper understanding of the fintech sector's movers and shakers. Don't hesitate to contact our sales team if you have any questions or want to explore partnership opportunities. Those interested in joining our dynamic team can visit our careers page to submit their CVs. Join us in exploring the future of fintech and the companies shaping it!