A Personal Journey into Digital Assets

At the beginning of 2021, I was sitting in front of my laptop and I have read about NBA Top Shot. I entered there. It took me a while to understand what people can buy and sell there.

That’s a video snapshot of an impressive dunk, cool — I thought.

After that, I recognized there was a price tag with USDs on it. Wait. USD price? How people can buy it or sell it with real money on the blockchain? That was a question that led me to the conclusion that big things will come.

During the past few months in 2021 and 2022, I and my brother(a more formally business partner of mine) had a couple of business events in which we have taken part. Three of them were in October and November in Portugal, the United Kingdom, and Dubai. The last conferences and business trips took place in the United States in February and March. Mainly our purpose was to reach potential cooperations in these markets, find some partnerships, and simply present our company’s brand. At that time I was kind of fed up with noise about NFTs. In Poland, every week one article or one audition in broadcasts was related to that. The main point of discussion was the unbelievable revenue gathered by creators (celebrities, huge corporations, popular music producers, or top-notch artists) via selling their own NFTs in the Ethereum blockchain. It’s enough to say that everyone was and is focused only on the incredible money made on digital “art”. In every situation, I was a bit disappointed about the lack of expertise in these articles. That’s why being on a business trip I didn’t want to talk about that as most people identify selling and buying NFTs as a scam. How surprised I was when during the opening night of WebSummit the leading topic was presented. You guessed it. It was NFT.

From CryptoKitties to NBA Top Shot

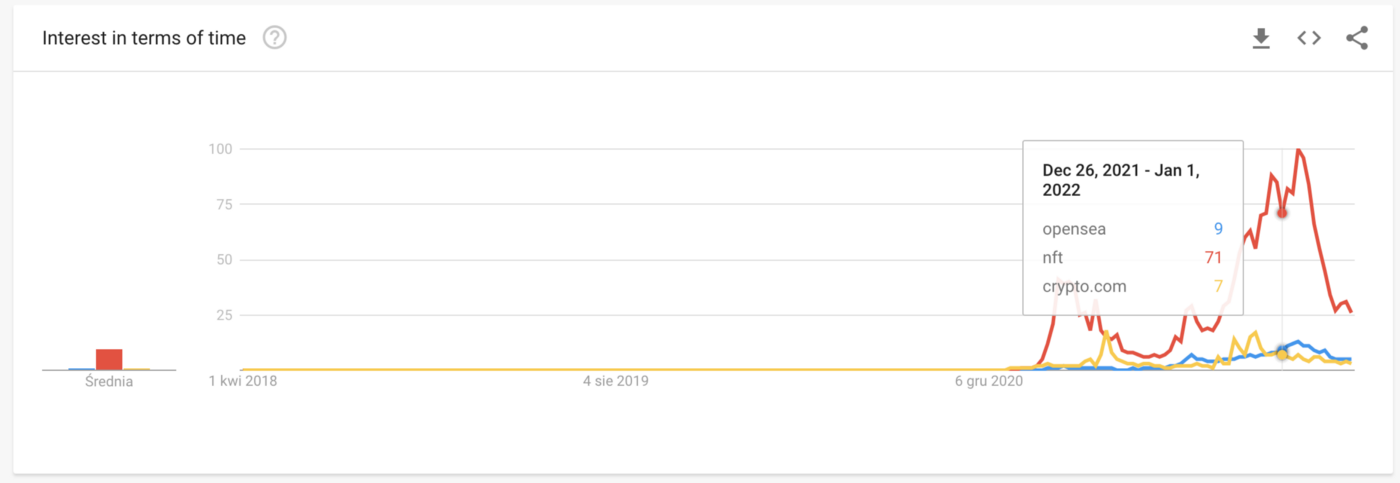

The innovation has the process of implementation. Like everything in the past we have introduction, growth, maturity, decrease, and finally withdrawal. We can say that officially Non-fungible tokens have started mainly in 2017 when ERC-721 has been proposed in Ethereum. The introduction took place 5 years ago and in the same year, Cryptokitties was released. It was popular for a small period of time but became less and less attractive for end users because of gas prices (money needed to process math calculations). I don’t want to go into details but simply in CryptoKitties creating NFTs requires 2 cats (which are NFTs) to create 1 cat (also NFT). The metadata hidden under 1 cat is unique and stores the history of its parents. This metadata was a reason why gas prices for creating the next kitties were and are so high. More parents in history led to more math calculations, more power(math needs energy 🏃), and more gas is needed to be spent. That’s why the user base started decreasing and this topic went away unnoticed. The growth of NFTs could see after that. A platform like OpenSea is the main beneficiary here. Just look at the google trends chart:

Of course, I don’t want to put the Opensea on the throne but let me explain why I think Opensea did a great deal (in theory).

For people, they’ve built a marketplace where everyone can enter and sell their digital goods and for developers, they’ve built API for setting simple smaller marketplaces where other people can do the same thing. You may think: “Why do they create an API for doing the same thing? Isn’t it the most stupid business idea?”. It’s not because NFTs are more around royalties than just selling and buying digital art. Opensea set up simple tools for making marketplaces. These marketplaces are connected to deployed Opensea’s contract where they have a defined margin for transactions handled within the marketplace’s goods. It’s set to 2,5% of the price that is sold. It’s not a lot but imagine that many people(artists) would set up their own marketplace for selling their art. This API (in my opinion) is simple enough to start something quickly, put your brand on it, and start selling. Opensea does not pay for advertisement because it’s your marketplace but takes some money in occurring transactions. Sounds perfect.

It’s worth to mention that is only theory without any proof of it that is good or bad approach. They are doing it in this way but in the market we can see a lot of other markerplaces doing the same job but in the traditional way, by telling us that they are the best.

I have started with CryptoKitties history to show the introduction. During the last 4 years, we had a growth. Is it time for maturity?

The creator of CryptoKitties is called Dapper Labs. After this metadata gas-related issue they decided they will build their own blockchain. Blockchain is designed for NFTs. The name is Flow.

With their own technology, they launched the marketplace called NBA Top Shot. It’s enough to say that NBA started the cooperation in the blockchain environment. It’s no longer random images. Now you can buy and sell moments of NBA.

Psychologically it’s a great step forward because you have a huge brand on it so you can assume that it has value. And that’s the main point. NFTs have real value if most people say that. With a big brand, we do not have to convince people about the price. Our brand has already done it.

The second thing is transactions handled in USD. Flow technology does something which Ethereum can’t. It can process transactions between users in blockchain under the hood and end-users can pay with real money to start doing these transactions. There are still “gas prices” and cryptocurrencies but traders do not see them. That’s the magic.

Of course I won’t dive into security debate. You can think of storing private keys and having unauthorized access to cryptoaccounts etc. However, how many scams you have seen already in the Ethereum blockchain?

Maturity, Mainstream Acceptance, and Security Concerns

We have big brands and prices in real money. Is it maturity? Not exactly. Now we can see that the media are not focused on it as they were one year ago. Definitely, we can say that’s the beginning of fundamental changes in the crypto world. With Flow, you can be a part of it and you do not have to have your own crypto wallet. This is a breakthrough because people are scared of losing their money. The Crypto world is still associated with the dark web and unclear transactions. With big brands and normal payments, it has a chance to go mainstream. It still needs more and more institutions inside this process. Without them, it will be hard to convince someone about its security and its value.

I have called it a rollercoaster because it’s only 5 years. Bitcoin has been released in 2009 and apart from changes in price and media rush, we are still at the point where other, more effective, more trendy cryptocurrencies are being created. In the NFT world, we are mainly around Ethereum and second created blockchain and language for it is designed to handle payments in fiat currency. This aggregation can lead to further rapid changes as we will be more focused on using these tools instead of creating a new one.

Web3 and Blockchain Development Insights

As the blockchain landscape continues to grow, it's clear that the value of NFTs and Web3 technology extends far beyond mere monetary worth. At Mobile Reality, we're at the forefront of exploring the potential of these technologies. We invite you to peruse our detailed articles that offer rich insights into the world of Web3 and blockchain software development:

- The true value of NFT is not only about money

- The Merge - How Ethereum Will Use 99,5% Less Energy

- What are the benefits you can get by buying an NFT?

- Guide to NFTs: When and how to invest in NFTs

- Guide to NFTs: When to mint own collection?

- Top 10 Web3 Blockchain Real Estate Companies

- Blockchain Web3 Music Companies you Should Know in 2025

- Leveraging Blockchain for Fintech: A Look Ahead to 2025

- Top Blockchain Conferences That You Cannot Miss in 2025

- Maximize Your NFT Marketplace Development in 2025

- DePIN: Power of Blockchain for Infrastructure Networks

These resources are curated to broaden your understanding and inform your decisions in Web3 and blockchain. By the way, Mobile Reality has been recognized as one of the top blockchain development companies by Vendorland. Contact our expert sales team for potential collaborations if you consider venturing into NFTs, blockchain, or web3 development. For those aspiring to be part of our innovative team, we encourage you to explore career opportunities on our careers page. Join us as we delve into the transformative world of blockchain technology!